|

Furthermore, in October 2023, domestic individual investors closed 545,326 securities trading accounts, which has also played a role in a significant drop in market liquidity.

During the trading session on November 7, the stock market encountered profit-taking pressure from investors, especially following a 70-point increase from the recent low, which led to the VN-Index opening the session with a decline. Apart from a few moments when it briefly exceeded the reference level, the VN-Index was predominantly flooded in red for most of the session. The market witnessed consistent fluctuations due to a significant increase in selling pressure, while demand remained relatively weak, resulting in the VN-Index concluding the session with a nearly 10-point decrease. Furthermore, the market lost foreign capital support as they shifted to become net sellers, selling shares worth nearly VND240 billion on the HOSE after two consecutive sessions of net buying.

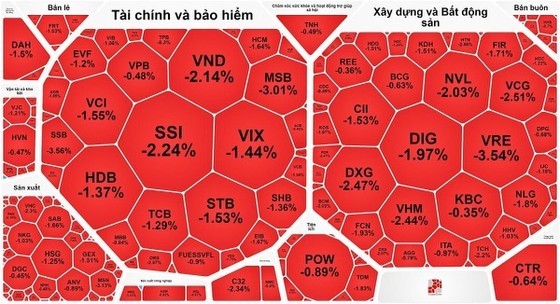

While there were no floor-limit declines, most sectors saw their points losing. With a few exceptions, including stocks like CTD, which soared by 4.09 percent, and HPG, MWG, and LPB, which rose by nearly 1 percent, the majority of the market was characterized by losses.

The securities sector experienced substantial declines. Specifically, SSI decreased by 2.24 percent, VND fell by 2.14 percent, HCM was down by 1.64 percent, VCI saw a 1.55 percent drop, AGR declined by 1.09 percent, BVS witnessed a 1.67 percent decrease, and VIX dropped by 1.44 percent.

Similarly, the real estate and construction segment also faced declines, with VHM retreating by 2.44 percent, DXG falling by 2.47 percent, PDR decreasing by 2.41 percent, BCM experiencing a 2.02 percent drop, DIG declining by 1.97 percent, DRH shrinking by 2.25 percent, NLG down by 1.8 percent, HDC sliding by 1.22 percent, KDH reducing by 1.5 percent, and CII cutting by 1.53 percent.

In the banking sector, stocks also trended in the red, with VCB losing by 1.34 percent, TCB devaluing by 1.29 percent, SSB slumping by 3.56 percent, STB trimming by 1.53 percent, and HDB weakening by 1.37 percent.

The VN-Index slashed 9.37 points, or 0.86 percent, to settle at 1,080.29 points, featuring 378 declining stocks, 138 advancing stocks, and 83 unchanged stocks.

Wrapping up the trading session on the Hanoi Stock Exchange (HNX), the HNX-Index also chopped 1.3 points, or 0.59 percent, to close at 218.29 points, with 103 losers, 65 winners, and 50 unchanged stocks.

Market liquidity continued to drop by around VND1 trillion compared to the previous session, with the total trading value across the entire market at approximately VND15 trillion.

In a related development, information from the Vietnam Securities Depository (VSD) reveals that during October 2023, domestic individual investors closed 545,326 securities trading accounts. Consequently, the number of investor trading accounts reduced from 7.8 million accounts at the end of September to 7.45 million accounts by the end of October. This marks an unprecedented occurrence in the 23-year history of the Vietnamese stock market. Individual investors closed securities accounts during a month of negative trading in the Vietnamese stock market, as the VN-Index plunged by almost 11 percent. Additionally, foreign investors also registered net selling for the seventh consecutive month, resulting in a total net withdrawal from the stock market in October 2023, amounting to more than VND2.72 trillion.

The sharp decrease in the number of individual investor securities accounts may be linked to initiatives aimed at data cleansing. In October 2023, the Prime Minister directed the State Securities Commission to establish a connection with the national population database to purify data concerning individuals involved in securities trading, which involves cross-referencing information to ensure accuracy and remove incorrect, duplicated, or fictitious data. The deadline for completing this task was November 2023.