|

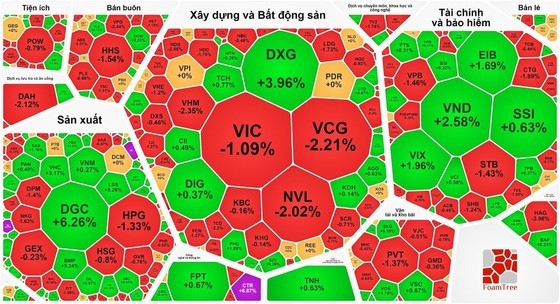

During the trading session on September 29, the Vietnamese stock market saw a notable surge in market liquidity. While the trio of Vingroup companies was flooded in red, with VIC declining by 2.01 percent, VRE slumping by 1.68 percent, and VHM slipping by 0.18 percent, several real estate stocks still demonstrated robust growth on the market, fueled by increased capital influx.

Specifically, HDC rose by 2.62 percent, KBC surged by 2.79 percent, PDR soared by 6.67 percent, BCM advanced by 2.74 percent, QCG jumped by 3.57 percent, IDC climbed by 2.61 percent, LDG increased by 4.86 percent, and NVL edged up by 1.75 percent.

The banking and securities sectors also exhibited positive momentum. Within the banking sector, VCB rallied by 1.61 percent, VPB escalated by 2.71 percent, while BID, CTG, SSB, and STB recorded gains of nearly 1 percent. Among securities stocks, VCI posted an increase of 2.95 percent, HCM grew by 1.32 percent, FTS advanced by 1.69 percent, and ORS and VDS climbed by 1.69 percent and 3.64 percent, respectively. In addition, numerous retail and manufacturing stocks also showed strong performance, with SAB up by 1.15 percent, GVR up 2.23 percent, MWG up 2.32 percent, and PNJ up 1.13 percent.

After a net buying session the previous day, foreign investors shifted back to net selling during this trading session, resulting in a total net sell value on the HOSE of nearly VND206 billion. The stocks that experienced the most significant net selling included SSI, BCM, STB, DPM, and MSN.

By the end of the trading session, the VN-Index elevated by 2.71 points, or 0.23 percent, to close at 1,204.43 points, with 281 advancing stocks, 203 declining stocks, and 88 stocks remaining unchanged.

On the Hanoi Stock Exchange, the HNX-Index also experienced an increase of 1.6 points, or 0.65 percent, to reach 246.48 points. Among the index members, 114 stocks went up, 84 went down, and 61 stayed still.

The market liquidity improved compared to the previous session, with the total trading value reaching nearly VND25.2 trillion.