Notably, Vietcombank's VCB stock alone soared drastically, contributing around eight out of the 17 points gained by the VN-Index.

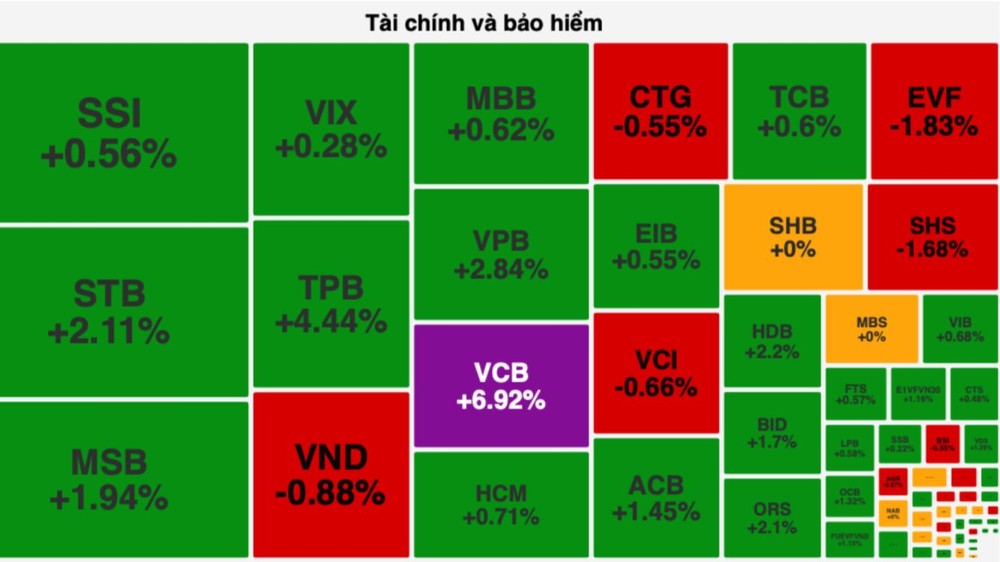

In the trading session on February 28, the stock market continued its strong upward trend, propelled by large-cap stocks. The remarkable rise in the VN-Index was mainly fueled by the banking sector, with VCB hitting the ceiling, TPB surging by 4.44 percent, VPB climbing by 2.84 percent, HDB advancing by 2.2 percent, STB increasing by 2.11 percent, MSB rising by 1.94 percent, BID growing by 1.7 percent, ACB gaining by 1.45 percent, OCB improving by 1.32 percent; TCB, MBB, EIB, and VIB also posted gains of nearly 1 percent.

The securities stock group also showed a preference for green. Of which, ORS strengthened by 2.1 percent, VDS added up by 1.29 percent; SSI, VIX, HCM, FTS, and CTS emerged by nearly 1 percent.

Vietcombank's VCB stocks hit the ceiling after the bank finalized plans to utilize nearly VND21.7 trillion in profits from 2022 for dividend payouts. Accordingly, Vietcombank plans to distribute 2022 dividends in shares at a rate of 38.79 percent.

The real estate - construction group faced significant selling pressure, resulting in a tendency towards red, with CEO losing by 1.35 percent, DIG retreating by 1.28 percent, NTL reducing by 1.47 percent; NVL, PDR, VCG, DXG, TCH, NLG, LCG, HHV, CII, and BCG sliding by nearly 1 percent. However, the trio of Vingroup simultaneously demonstrated sharp gains, with VRE soaring by 5.3 percent, VIC mounting by 1 percent, and VHM edging up by nearly 1 percent, contributing significantly to the robust increase of the VN-Index.

Furthermore, the oil and gas stock group also saw active trading, with PVD hitting the ceiling, BSR spiraling by 3.59 percent, and PVS escalating by 1.92 percent. Additionally, several manufacturing stocks showed strong performance. Specifically, BAF jumped by 6.35 percent, DBC hiked by 1.68 percent, DCM elevated by 1.19 percent, DPM enlarged by 1.01 percent, and MSN grew by 1.04 percent.

At the end of the trading session, the VN-Index climbed by 17.09 points, or 1.38 percent, to reach 1,254.55 points, with 309 stocks rising, 180 stocks falling, and 67 stocks holding steady. Conversely, the HNX-Index closed marginally lower, slipping by 0.22 points, or 0.09 percent, to 235.16 points, with 97 winners, 82 losers, and 62 unchanged stocks. While trading volume dipped slightly compared to the previous session, it still maintained at a high level, with total trading value on the HOSE reaching approximately VND22.7 trillion, down by around VND400 billion from the previous session.

Foreign investors continued their net buying streak for the third consecutive session on the HOSE, with total buying value nearing VND222 billion.