The massive surge in trading volume caused widespread system overloads. Several brokerage platforms—including TCBS, SSI, DNSE, and VNDirect—experienced connectivity issues and system freezes as order flow overwhelmed their infrastructure.

The session witnessed an explosion in both liquidity and trading volume, accompanied by dramatic volatility in the VN-Index. At one point, the index surged past its previous all-time high of 1,557.42 points (set on July 28), climbing to an intraday peak of 1,583 points.

However, mounting sell-off pressure in the late afternoon drove the VN-Index down sharply to 1,520 points before it rebounded to close at 1,547.15 points. The session saw a staggering intraday swing of over 60 points, with several stocks flipping from ceiling gains to floor losses — a rollercoaster trading day that left investors emotionally drained.

Large-cap stocks continued their upward momentum and helped shore up the index. In particular, the Vingroup ecosystem contributed approximately 10 points to the VN-Index, with VIC soaring 5.67 percent, VHM gaining 4.12 percent, and VRE jumping 6.36 percent.

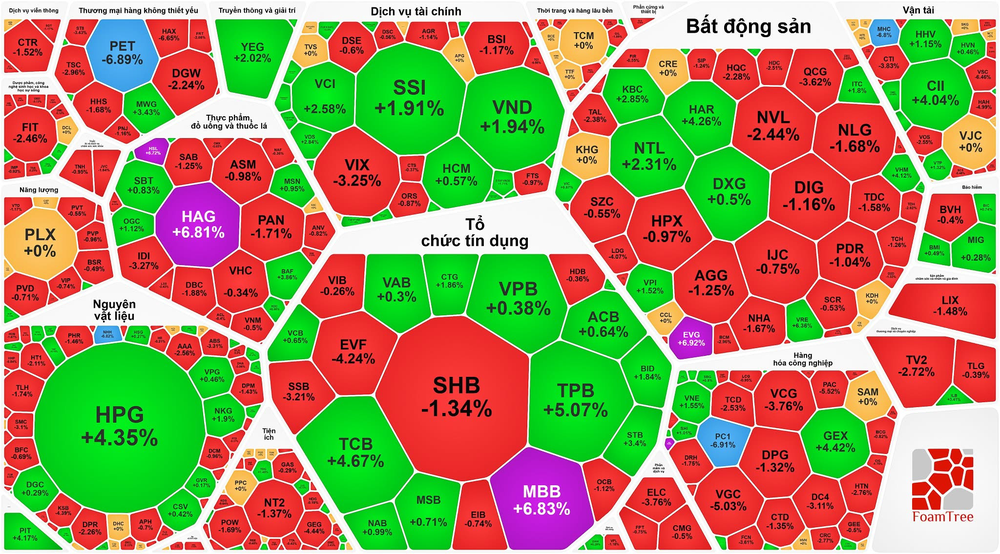

Banking stocks also saw robust gains: MBB hit its ceiling price; TCB rose by 4.67 percent; TPB gained 5.07 percent; STB climbed by 3.4 percent; BID added 1.84 percent; BVB rose 2.14 percent; LPB gained 1.73 percent; and CTG advanced by 1.86 percent.

Securities stocks showed mixed performance amid strong profit-taking. While many lost their ceiling gains, several remained in positive territory: VCI rose 2.58 percent, SSI climbed 1.91 percent, VDS added 2.84 percent, and VND gained 1.94 percent. HCM and MBS both edged up nearly 1 percent. On the flip side, VIX dropped 3.25 percent; BSI slid 1.17 percent; AGR retreated by 1.14 percent; SHS reduced 1.69 percent; while CTS, ORS, and CTS all slipped nearly 1 percent.

In the real estate sector, apart from the sharp rise of Vingroup stocks, most other property shares turned red: NVL fell 2.44 percent; PDR sank 1.04 percent; HDC declined 2.51 percent; DIG lost 1.16 percent; NLG collapsed 1.68 percent; TCH weakened 1.26 percent; and AGG went down 1.28 percent.

Elsewhere on the market, several stocks posted significant gains: HAG hit the ceiling; HPG climbed 4.35 percent; GEX enlarged 4.42 percent; and MWG strengthened 3.43 percent.

At market close, the VN-Index rose 18.96 points, or 1.24 percent, to 1,547.15, with 118 stocks gaining, 221 declining, and 40 remaining unchanged. Meanwhile, on the Hanoi Stock Exchange, the HNX-Index dropped 2.22 points, or 0.83 percent, to 266.12, with 111 decliners, 65 advancers, and 57 unchanged stocks.

Liquidity reached a historic high, with total trading value on HOSE nearing VND78.2 trillion — an increase of VND35.5 trillion compared to the previous session. Including the HNX, total market liquidity hit close to VND84 trillion (around $3.2 billion), up VND37.1 trillion from the day before.

In this session, foreign investors extended their selling streak on HOSE to a fourth consecutive session, net selling nearly VND2.52 trillion. VIC alone accounted for more than VND2.89 trillion in net foreign outflows, followed by SHB with VND227 billion and VPB with VND199 billion.