Although it has significantly narrowed the decline compared to the highest drop during the session, at the close of the last trading session of the week, the VN-Index has fallen below the 1,500-point mark. Foreign investors continued to sell off nearly VND2.3 trillion (US$877 million) on the HOSE exchange.

The stock market experienced strong volatility around the 1,500-point threshold during the August 1 trading session. At the market open, the VN-Index rose nearly 7 points, but quickly reversed into a steep decline as selling pressure intensified. At one point, the VN-Index dropped nearly 29 points to 1,480, before narrowing the loss to just under 8 points by the session close.

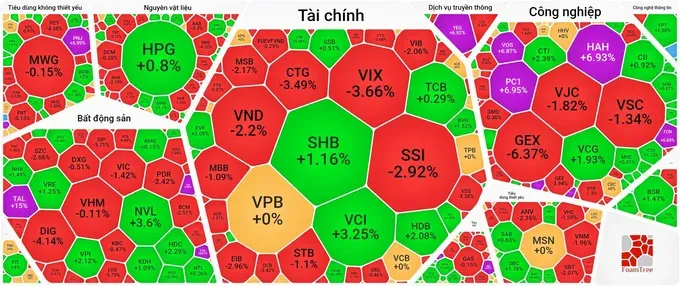

Stocks that were previously overheated, particularly in the securities and real estate sectors, have reversed direction due to significant selling pressure. In particular, securities stocks experienced notable declines; for instance, SHS decreased by 6.52 percent, FTS dropped by 4.74 percent, VIX fell by 3.66 percent, MBS lost 3.3 percent, SSI declined by 2.92 percent, CTS fell by 3.68 percent, and VND slid by 2.2 percent.

Similarly, real estate stocks also trended into negative territory with large losses. Specifically, SCR dropped 6.98 percent, DIG declined 4.14 percent, VIC lost 1.42 percent, PDR fell 2.42 percent, CEO dropped 3.32 percent, TCH declined 3.97 percent and NLG slid 3.13 percent.

Banking stocks showed mixed performance, but the red outweighed the green; for example, OCB fell 3.42 percent, CTG dropped 3.49 percent, VIB declined 2.06 percent, MSB lost 2.17 percent, BID dropped 1.72 percent, EIB fell 2.96 percent and BVB decreased 1.42 percent. On the other hand, SHB rose 1.16 percent, HDB gained 2.08 percent; TCB, LPB, and SSB all rose nearly one percent respectively.

Notably, some stocks in the industrial and consumer sectors bucked the overall market trend and surged to the daily limit such as HAH, FCN, PC1, VOS, and PNJ all hit their ceiling prices.

At the close of the session, the VN-Index lost 7.31 points ( or 0.49 percent) to settle at 1,495.21 points, with 180 stocks declining, 141 advancing, and 54 remaining unchanged. On the Hanoi exchange, the HNX-Index also fell 1.41 points ( or 0.53 percent) to 264.93 points, with 100 stocks declining, 71 rising, and 64 unchanged. Liquidity dropped, with total trading value on the HOSE reaching nearly VND39.1 trillion, down VND3.7 trillion from the previous session. Including the HNX, total market liquidity was around VND42.9 trillion, a decrease of VND4.8 trillion compared to the previous session.

In this session, foreign investors strongly extended their net selling streak on the HOSE for a second consecutive day, with a massive net selling value nearing VND2.3 trillion. The top three most heavily net-sold stocks were SSI with over VND466 billion, CTG with nearly VND386 billion and FPT with over VND287 billion.