The market also witnessed a remarkable debut as newcomer F88 Investment Joint Stock Company (ticker: F88) listed at VND634,900 per share—the highest starting price across the entire market. On its first trading day, F88 surged to the daily ceiling of VND888,800 per share.

F88 brought 8.26 million shares to trade on the UPCoM exchange at VND634,900 per share, setting the record for the highest market price among all three Vietnamese stock exchanges on August 8. After hitting the 40 percent daily ceiling in its debut session, the company’s market capitalization jumped from VND5.25 trillion to nearly VND7.3 trillion. This positioned F88 ahead of the market’s previous high-priced leaders, including WCS (Western Coach Station JSC) at VND411,000 per share and VNG (VNG Corporation) at VND396,400 per share.

As for the broader market, the August 8 session marked the third consecutive record-setting day for the stock market. The VN-Index now stands less than 15 points shy of the 1,600-point milestone.

During the session, the index faced sharp selling pressure, at one point falling nearly 17 points to 1,565. However, robust demand quickly absorbed the sell-off, driving the VN-Index up by more than 20 points intraday before closing just under 1,585.

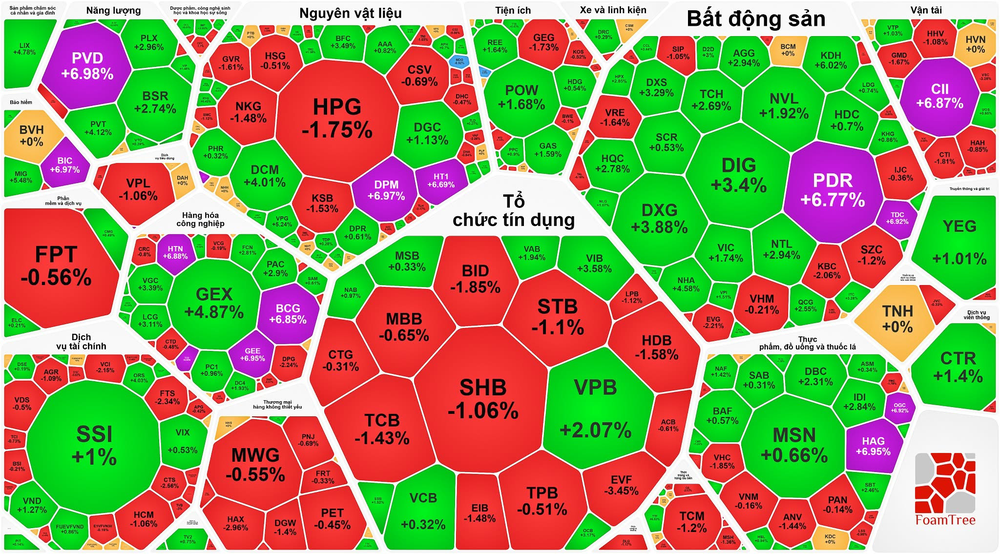

Real estate and public investment stocks attracted heavy inflows, with many hitting the ceiling, including PDR, CII, GEE, and BCG. Several others posted strong gains—CEO rocketed 7.56 percent, KDH gained 6.02 percent, DXG climbed 3.88 percent, GEX advanced 4.87 percent, VGC rose 3.39 percent, and LCG increased 3.11 percent.

In contrast, banking and securities stocks saw heavy profit-taking and mostly closed in the red: SHB down 1.06 percent, TCB 1.43 percent, HDB 1.58 percent, EIB 1.48 percent, BID 1.95 percent, STB 1.1 percent, LPB 1.12 percent; FTS dropped 2.34 percent, CTS 2.56 percent, VCI 2.15 percent, and SHS 2.9 percent.

Meanwhile, consumer, energy, and materials stocks traded positively, with several touching or nearing their daily ceilings, namely HAG, PVD, DPM, and HT1.

At the close, the VN-Index gained 3.14 points, or 0.2 percent, to 1,584.95, with 177 gainers, 155 decliners, and 51 flat stocks. On the Hanoi exchange, the HNX-Index rose 1.6 points, or 0.59 percent, to 272.46, with 92 gainers, 78 decliners, and 60 unchanged. Liquidity surged, with the total trading value on HOSE reaching nearly VND49.2 trillion—up VND5 trillion from the previous session. Including HNX, total market liquidity climbed to almost VND54.3 trillion, an increase of VND6.6 trillion.

Foreign investors extended their net selling streak to a second session, offloading nearly VND834 billion worth of shares. The top three most heavily sold stocks were BID (over VND216 billion), SSI (more than VND202 billion), and HPG (nearly VND149 billion).