|

The VN-Index dropped in the last trading session of 2022, causing many investors to enter the trading session on January 3 cautiously. Both buyers and sellers only placed orders around the reference price with a low quantity to probe the signal of the market.

However, seeing that the holders did not make any move to dump shares, investors rushed to place buying orders above the reference price. This green price demand quickly sucked up the exploratory selling orders of stockholders. Therefore, many stocks were already sold out even though the market had only gone half the time of the morning trading session.

The fact that several stocks saw excess buying orders at the ceiling price created more excitement for money holders. Buying orders were distributed to stocks that did not rally strongly with the expectation of gaining a head start on the market's recovery. Thanks to that, VN-Index's gain was continuously pushed higher when the market entered the last minutes of the trading session.

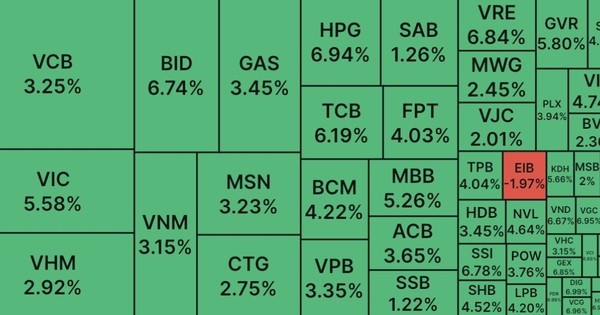

The VN-Index soared 36.81 points, or 3.66 percent, to close at 1,043.9 points. The green color almost completely covered the market in the first trading session of 2023. Specifically, there were 352 gainers, 74 losers, and 31 unchanged stocks on the HoSE.

Meanwhile, the green color dominated the VN30 basket with all 30 advancing. Of these, four stocks jumped the daily maximum limit, including VRE, SSI, PDR, and HPG. The VN30-Index ended the session with a much more impressive gain than the VN-Index with 4.18 percent, or 42 points, to 1,047.25 points.

Besides stocks in the VN30 basket, the VN-Index also received support from large-cap stocks, such as real estate, steel, and securities. According to statistics, the stocks belonging to these three sectors appeared with an overwhelming number in the list of nearly 70 stocks that hit the ceiling price today of the HoSE.

Compared to the last session of 2022, market liquidity improved significantly but still could not surpass the VND10 trillion mark. In the trading session on January 3, only over 551.3 million shares were matched successfully on the HoSE, equivalent to VND9.25 trillion. In which, the trading value of the VN30 basket accounted for more than 39 percent, reaching VND3.61 trillion.

The excitement of the HoSE was also a factor that helped the HNX-Index to end the first trading session of 2023 with a relatively high increase. Specifically, the HNX-Index climbed 7.26 points, or 3.53 percent, to 212.56 points. Meanwhile, the UPCoM-Index only edged up 0.76 points, or 1.06 percent, to finish at 72.4 points.

Foreign investors bought VND944 billion and sold VND715 billion worth of shares. Thus, after net buying in the last two months of 2022, foreign investors continued to be net buyers in the first session of 2023, with a net buying value of nearly VND230 billion.

* On the same day, the State Bank of Vietnam (SBV) announced the reference exchange rate between the US dollar and the Vietnamese dong at VND23,612 per dollar, down VND6 compared to the previous announcement.

The US dollar buying and selling prices at the SBV Operation Center were VND23,450 and VND24,780, respectively.

The exchange rate on the free market saw a decrease in the buying rate and an increase in the selling rate. The US dollar was bought at VND23,700 and sold at VND23,800, down VND15 for buying and up VND25 for selling.

The US dollar buying and selling prices at commercial banks moved in the same direction as the free market.

Specifically, Vietcombank listed the buying and selling prices at VND23,370 and VND23,690, down VND40 compared to the end of last year.

BIDV bought US dollars at VND23,390 and sold them at VND23,670, down VND15 for buying and selling rates.

VietinBank bought and sold US dollars at VND23,370 and VND23,690, down VND13.

The US dollar exchange rate at Eximbank was at VND23,390 and VND23,660, up VND10 in the buying rate and down VND40 in the selling rate.

ACB listed the US dollar price at VND23,400 for buying and VND23,660 for selling, down VND30 for buying and VND10 for selling.