Banking stocks rally robustly, helping the market recover. (Photo: SGGP)

Banking stocks rally robustly, helping the market recover. (Photo: SGGP)

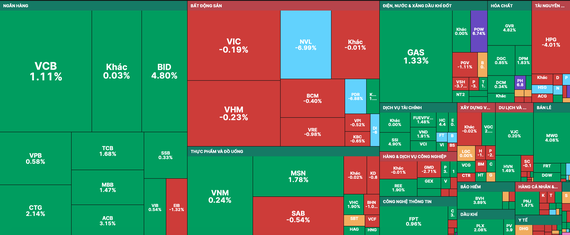

Vietnam’s stock market continued to decline sharply on November 8 because real estate stocks still hit the floor massively. Although banking and securities stocks that attracted the cash flow rebounded, they could not balance the index.

Large-cap real estate stocks, such as NVL, VIC, VHM, and BCM, fell to the floor, causing the VN-Index to drop nearly 14 points sometime, retreating to close to 961 points.

However, after that, with the efforts of financial stocks, many banking stocks increased strongly. Specifically, BID surged by 4.8 percent, LPB and STB both jumped by 6.1 percent, SHB rose by 4.2 percent, and ACB gained by 3.1 percent. Securities stocks also made a breakthrough, with SSI going up 4.9 percent, SHS climbing 4.2 percent, VCI edging up 3.9 percent, and HCM enhancing 4.4 percent, helping the market recover.

Oil and gas stocks also rallied robustly, with PVS soaring by 6.48 percent, GAS advancing 1.33 percent, PVD mounting 3.98 percent, and PLX enlarging 2.1 percent. Another positive point is that foreign investors bought heavily on two official exchanges, with a total trading value of more than VND624 billion.

Besides many real estate stocks that still fell to the floor at the close, such as NVL, PDR, DIG, CKG, DRH, DXG, ITC, and LDG, steel stocks saw HSG and NKG dropping to the floor, and HPG losing more than 4 percent.

Ending the trading session, the VN-Index resurrected 6.46 points, or 0.66 percent, to 981.65 points, with 209 gainers, 232 losers, and 69 unchanged stocks. Closing the trading session on Hanoi Stock Exchange, the HNX-Index also restored 1.21 points, or 0.61 percent, to 199.77 points, with 72 winners, 96 losers, and 51 unchanged stocks.

Market liquidity on the two official exchanges was just over VND11 trillion.

Large-cap real estate stocks, such as NVL, VIC, VHM, and BCM, fell to the floor, causing the VN-Index to drop nearly 14 points sometime, retreating to close to 961 points.

However, after that, with the efforts of financial stocks, many banking stocks increased strongly. Specifically, BID surged by 4.8 percent, LPB and STB both jumped by 6.1 percent, SHB rose by 4.2 percent, and ACB gained by 3.1 percent. Securities stocks also made a breakthrough, with SSI going up 4.9 percent, SHS climbing 4.2 percent, VCI edging up 3.9 percent, and HCM enhancing 4.4 percent, helping the market recover.

Oil and gas stocks also rallied robustly, with PVS soaring by 6.48 percent, GAS advancing 1.33 percent, PVD mounting 3.98 percent, and PLX enlarging 2.1 percent. Another positive point is that foreign investors bought heavily on two official exchanges, with a total trading value of more than VND624 billion.

Besides many real estate stocks that still fell to the floor at the close, such as NVL, PDR, DIG, CKG, DRH, DXG, ITC, and LDG, steel stocks saw HSG and NKG dropping to the floor, and HPG losing more than 4 percent.

Ending the trading session, the VN-Index resurrected 6.46 points, or 0.66 percent, to 981.65 points, with 209 gainers, 232 losers, and 69 unchanged stocks. Closing the trading session on Hanoi Stock Exchange, the HNX-Index also restored 1.21 points, or 0.61 percent, to 199.77 points, with 72 winners, 96 losers, and 51 unchanged stocks.

Market liquidity on the two official exchanges was just over VND11 trillion.