|

The stock market has witnessed a significant surge in the securities group, driving a robust overall market increase. Notably, the VN-Index has not only recouped all the points it lost on the previous day but has also reclaimed its recent peak at 1,245.44 points.

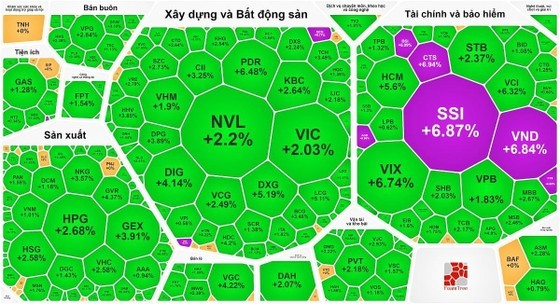

The Vietnamese stock market on the trading session of September 12 recovered robustly after a significant drop the previous day. The focal point was the securities stock group, with most stocks experiencing remarkable gains. Among them, several stocks hit their daily trading limit, including SSI, VND, FTS, BSI, CTS, AGR, and MBS. Other stocks also saw increases of over 5 percent, such as VCI rising by 6.32 percent, ORS jumping by 6.32 percent, VDS soaring by 6.11 percent, HCM climbing by 5.6 percent, and VIX rocketing by 6.74 percent.

The green color also dominated the banking stock group, with MBB advancing by 2.67 percent, STB strengthening by 2.37 percent, TCB adding up by 2.17 percent, ACB going up by 1.79 percent, VPB growing by 1.83 percent, CTG gaining by 1.25 percent, VCB rising by 1.58 percent, and BID edging up by 1.08 percent.

The real estate stock group also staged a strong recovery. Among them, QCG and VPH hit their daily trading limit. The three companies under Vingroup saw VHM rise by 1.9 percent, VRE by 2.79 percent, and VIC by 2.03 percent. Additionally, NVL mounted by 2.2 percent, KBC enlarged by 2.64 percent, PDR escalated by 6.48 percent, DIG enhanced by 4.14 percent, TCH built up by 3.59 percent, DXG augmented by 5.19 percent, and CII surged by 3.25 percent.

Not only did the major stock groups perform strongly, but various other sectors, such as retail and energy, also showed notable gains. These upward trends collectively contributed to the VN-Index's increase of almost 22 points at the session's conclusion.

At the close of the trading session, the VN-Index revived 21.8 points, or 1.78 percent, with 407 winners, 116 losers, and 46 stocks remaining unchanged. Meanwhile, on the Hanoi Stock Exchange (HNX), the HNX-Index also climbed by 4.99 points, or 1.99 percent, with 128 stocks advancing, 62 stocks declining, and 60 stocks standing still. Another positive note is that foreign investors have returned to net buying with nearly VND340 billion on the HOSE.

Market liquidity was at a high level, with the total trading value reaching roughly VND26 trillion.