Market liquidity continued to improve thanks to banking stocks attracting capital inflows. Additionally, strong gains in blue-chip stocks during the derivatives expiration session pushed the VN30-Index up nearly 19 points.

On May 16, the stock market continued its strong upward momentum, bringing the VN-Index close to 1,280 points. In the VN30-Index basket which comprises the 30 largest-cap stocks in the market, only four out of 30 stocks, namely BCM, GVR, MWG, and SAB, declined, driving the index to a new peak of 1,308.27 points.

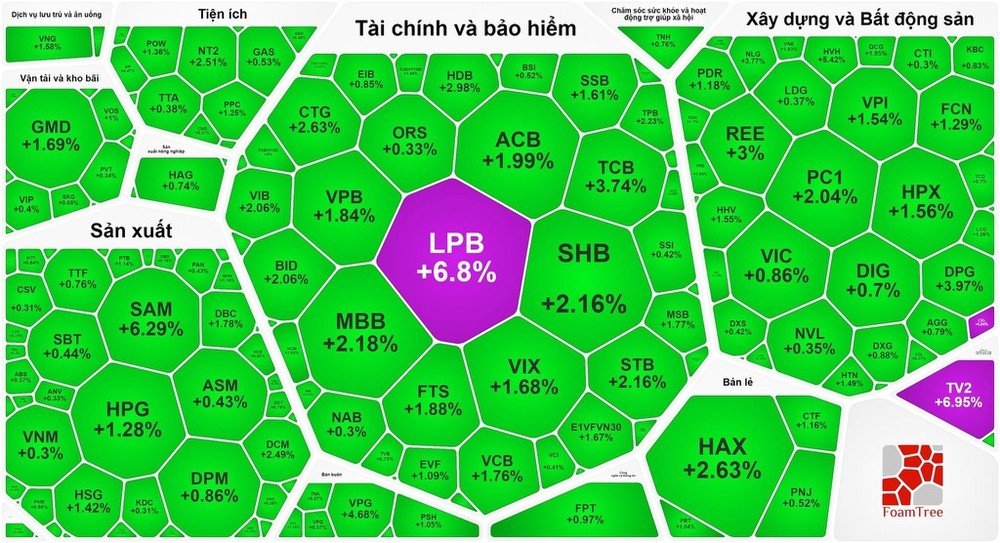

The banking stocks surged robustly, with no stocks dropping. Specifically, LPB hit the ceiling, OCB rocketed by 4.69 percent, TCB bounced by 3.74 percent, STB climbed by 2.16 percent, MBB hiked by 2.18 percent, CTG elevated by 2.63 percent, VPB advanced by 1.84 percent, SHB gained by 2.16 percent, TPB grew by 2.23 percent, BID won by 2.06 percent, and HDB strengthened by 2.98 percent.

The securities group also leaned toward green. VIX rose by 1.68 percent, HCM added up by 1.03 percent, FTS emerged by 1.88 percent; SSI, VCI, VND, CTS, AGR, ORS increased by nearly 1 percent.

The real estate - construction group also saw positive gains. NLG surged by 3.77 percent, DPG soared by 3.97 percent, HUT enlarged by 1.74 percent, LCG expanded by 1.26 percent, CEO stretched by 1.59 percent, PDR built up by 1.18 percent, HHV mounted by 1.55 percent, and VRE rallied by 1.34 percent.

Meanwhile, there was divergence in the manufacturing group, several stocks still performed well. DCM escalated by 2.49 percent, TNG augmented by 2.86 percent, HSG increased by 1.42 percent, and HPG raised by 1.28 percent. Additionally, the petroleum group also saw strong growth. PVS shot up by 4.59 percent, PVD spread by 2.19 percent, PVC jumped by 3.97 percent, and BSR improved by 2.63 percent.

At the close of the trading session, the VN-Index surged by 14.39 points, or 1.15 percent, to reach 1,268.78 points, with 300 stocks advancing, 129 declining, and 80 remaining unchanged.

Meanwhile, at the Hanoi Stock Exchange (HNX), the HNX-Index also climbed by 1.24 points, or 0.52 percent, to settle at 240.02 points, with 113 gainers, 73 losers, and 57 unchanged stocks.

Market liquidity continued to improve, with the total trading value on the HOSE reaching nearly VND22.7 trillion, up VND500 billion compared to the previous session.

Foreign investors also maintained net buying for the second consecutive session on the HOSE, albeit with a modest net buying volume of around VND7 billion.