|

The VN-Index during the trading session sometimes lost the 1,110-point mark after dropping by nearly 15 points because banking stocks plunged sharply. However, this group of stocks made a U-turn to gain robustly, helping to pull the VN-Index up by nearly 9 points to close near 1,112 points - an increase of about 24 points, equivalent to nearly 2 percent compared to the lowest point in the trading session.

The trading session on January 31 started with great selling pressure from banking stocks because investors dumped shares heavily, causing the market to be flooded in red. The fact that 26 out of 27 banking stocks on the market all plummeted, many of which fell from 2 to nearly 3 percent, putting great pressure on the indicator. The group of king stocks sank sharply, hurting the whole market when other stocks, such as securities, steel, oil and gas, and real estate, also decreased, causing the VN-Index to sometimes retreat to below 1,110 points.

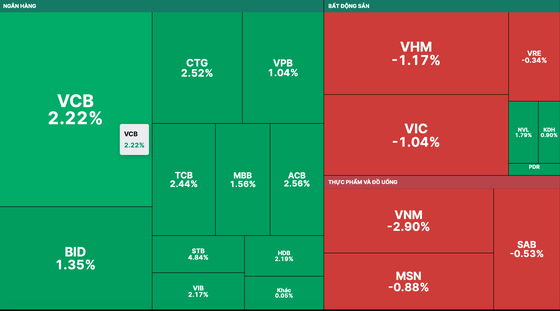

However, in the afternoon trading session, banking stocks suddenly rebounded, with only five out of 27 stocks losing. Of these, many stocks from a drop of more than 2 percent in the morning turned to advance strongly. Specifically, VCB went up 2.22 percent; CTG recouped 2.52 percent; BID edged up 1.35 percent; TCB restored 2.44 percent; STB jumped by 4.84 percent. This group of stocks brought about two-thirds of the VN-Index's gain. The reversal of banking stocks was quite pervasive. Accordingly, securities stocks also recovered well with SSI up 2.86 percent, VND up 1.85 percent, HCM up 3.7 percent, and VCI up 2.05 percent. Besides, HPG revived 1.61 percent, and VJC gained 2.92 percent.

Closing the trading session, the VN-Index surged 8.61 points, or 0.78 percent, to 1,111.18 points, with 258 gainers, 149 losers, and 63 unchanged stocks. Closing the session in Hanoi, the HNX-Index also advanced 1.65 points, or 0.75 percent, to stand at 222.43 points, with 105 gainers, 56 losers, and 59 unchanged stocks.

The buying demand increased strongly at the end of the session, but foreign investors sold a net value of more than VND115 billion on two official exchanges, with STB, DGC, VHM, and KDH being dumped the most, ending the previous six net buying sessions.

The market liquidity, although not as good as the previous day, still remained at a high level, with the total trading value on the two official exchanges at nearly VND15 trillion.