|

During the trading sessions on August 7, the Vietnamese stock market maintained a robust upward trajectory fueled by a consistent inflow of capital. The "king” stock group (banking stocks) attracted substantial investments, resulting in widespread gains within this sector. The resurgence of this prominent stock group played a pivotal role in driving the VN-Index to achieve new peaks in 2023.

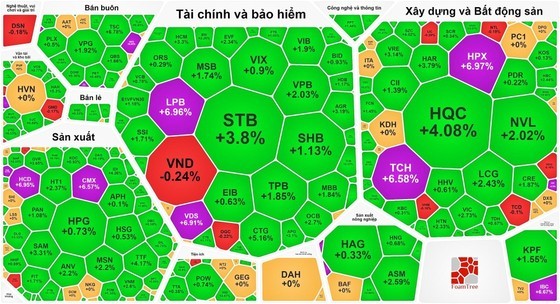

Several banking stocks demonstrated significant growth. Specifically, LPB surged to its upper limit, CTG jumped by 5.16 percent, STB increased by 3.8 percent, VPB gained 2.03 percent, SSB rallied 4.31 percent, TCB strengthened by 2.23 percent, VIB advanced by 1.9 percent, and MBB edged up by 1.84 percent.

Additionally, the cluster of large-cap stocks also contributed to propelling the VN-Index to its peak. For instance, VRE recorded a 3.14 percent increase, VIC added up by 2.73 percent, GVR soared by 3.65 percent, VNM observed a 2.6 percent uptick, and MSN ascended by 2.2 percent. Moreover, the securities stock segment sustained a robust upward momentum, as evidenced by VDS hitting the upper limit, HCM climbing by 3.3 percent, MBS enlarging by 2.24 percent, HHS surging by 3.87 percent, and SSI growing by 1.71 percent.

As the trading session concluded, the VN-Index hiked by 15.44 points, or 1.26 percent, to reach 1,241.42 points, with 342 stocks ascending, 129 declining, and 66 maintaining their previous levels.

Similarly, on the Hanoi Stock Exchange, the HNX-Index experienced a rise of 3.27 points, or 1.35 percent, to attain 245.68 points, with 130 stocks in the green, 66 in the red, and 71 remaining unchanged.

Notably, market liquidity remained high as the total trading value across the entire market approached VND30 trillion (equivalent to $1.3 billion).

During this trading session, in stark contrast to the optimism of local investors, foreign investors shifted towards net selling, totaling almost VND394 billion on the HOSE exchange.