|

Stock markets have fallen considerably on huge liquidity in the first trading session of the week. |

Vietnamese stocks slipped in today’s afternoon trading session with heavy selling off with huge liquidity; as a result, VN-Index fell nearly 30 points while foreign investors had a record net sale of nearly VND 1,062 billion on VN-Index on the Ho Chi Minh Stock Exchange (HoSE).

Today’s Vietnamese stock market opened with an immediate increase of nearly 10 points. However, after that, the selling force increased sharply, causing the market to drop gradually. Investors’ mood soon fled in panic so they turned to sell off stocks, causing the market to decline on a large scale. VN-Index increased from a 10-point increase to close the session down nearly 18 points, or 28 points during the session.

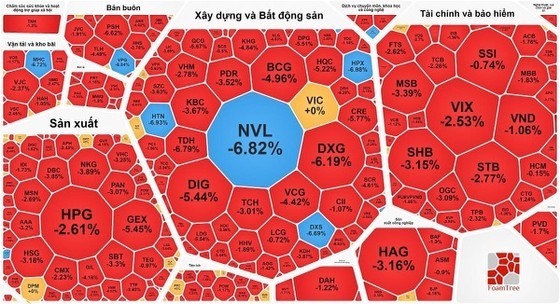

Stocks fell strongly, mainly driven by the losses of major blue chips, namely VHM, VRE, MSN, and HPG. For instance, at the beginning of the trading session, VIC increased by nearly 4 percent but at the end of the session also returned to the reference price while VHM decreased by 2.78 percent, VRE retreated by 3.04 percent, MSN decreased by 2.69 percent, HPG was down 2.61 percent which put great pressure on the index.

Real estate stocks fell the most. Specifically, NVL dropped to the floor, DXG dropped 6.19 percent, DIG dropped 5.44 percent, PDR dropped 3.52 percent, and HDC dropped 5.56 percent.

Banking stocks were also in the red except VPB increasing by 0.46 percent. For instance, STB decreased by 2.77 percent, TCB went down by 2.26 percent, VCB fell by 1.12 percent, CTG dropped by 1.24 percent, SSB decreased by 1, 82 percent, ACB declined 1.76 percent, VIB plummeted by 1.94 percent, MBB decreased 1.83 percent, BID plunged1.06 percent.

Although the securities stocks increased sharply during the session, VCI just increased by 1.3 percent, CTS soared by 1.2 percent, and AGR rose by 1.1 percent at the end of the session due to heavy selling off. Worse, many other stocks dropped quite sharply

Closing the session, VN-Index decreased 17.85 points or 1.44 percent to 1,223.63 points with 446 codes decreasing, only 85 codes increasing and 39 codes remaining unchanged.

Steel stocks NKG, HSG, and HPG slid 3.89 percent, 3.18 percent, and 2.61 percent respectively.

The HNX-Index on the Hanoi Stock Exchange (HNX) extended its downtrend at the closing session at 4,87 points, or 1.9 percent with 157 codes decreasing, 54 codes increasing and 56 codes remaining unchanged.

The volatility of the liquidity shock increased sharply with the total transaction value in the entire market of nearly VND 36,100 billion (US$ 1,506,476,952), with HOSE alone accounting for nearly VND 32,200 billion.

Not only did domestic investors sell off, but foreign investors also sold a record net of nearly VND 1,062 billion on the HOSE. In August 2023, foreign investors net sold VND 4,079 billion, an increase of 112 percent compared to the previous month. In the first week of September, foreign investors continued to sell VND1,305 billion on HOSE.