On May 22, the stock market experienced heavy selling pressure on blue-chip stocks, leading to a significant drop in the benchmark. The VN30-Index, which includes the 30 largest capitalized stocks in the market, saw 24 out of 30 stocks declining, causing this index to fall by nearly 18 points.

Alongside banking stocks, a sharp decrease in blue-chip stocks contributed to the VN-Index losing nearly 11 points. Notable decreases include VIC, with 2.05 percent, MSN, with 1.9 percent, BCM, with 1.87 percent, and VJC, with 3.02 percent.

Banking stocks saw widespread losses due to heavy selling. Specifically, ABB plunged by 6.59 percent, VPB sank by 2.66 percent, CTG retreated by 1.93 percent, TCB, MBB, and SHB reduced by 1.69 percent, EIB devalued by 1.36 percent, TPB went down by 1.09 percent, HDB depreciated by 1.42 percent, STB weakened by 1.06 percent, and VIB dropped by 1.77 percent.

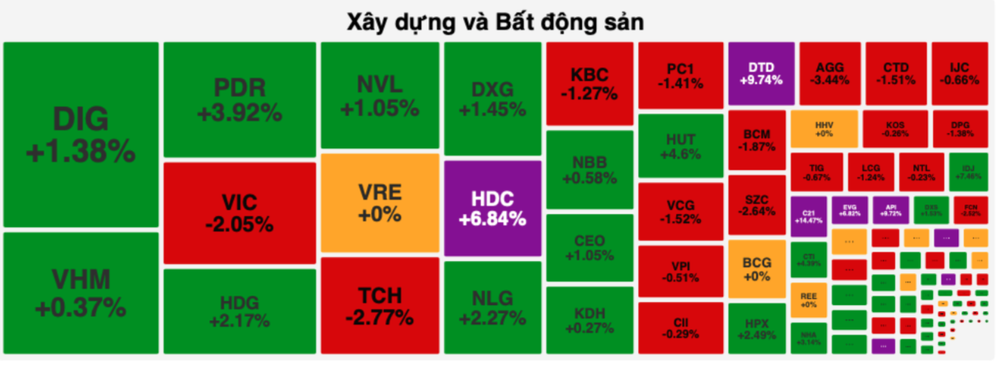

Meanwhile, the real estate and construction stock group surged significantly, with HDC, EVG, FDC, and FIR hitting their ceiling limits; PDR jumping by 3.92 percent, NHA escalating by 3.14 percent, NLG surging by 2.27 percent, HDG climbing by 2.17 percent, DXG advancing by 1.45 percent, HUT enlarging by 4.6 percent, CEO edging up by 1.05 percent, and DIG strengthening by 1.38 percent.

Similarly, numerous securities stocks also saw strong increases. HCM rallied by 2.69 percent, FTS gained by 1.08 percent, BVS grew by 1.43 percent, AGR enhanced by 1.24 percent, BSI mounted by 1.36 percent, and VDS advanced by 1.82 percent.

The manufacturing stock group was also flooded in red. DBC cropped by 2 percent, GEX collapsed by 2.58 percent, HPG shrank by 1.73 percent, TNG slashed by 2.29 percent, GVR crumbled by 1.65 percent, ASM cut by 2.07 percent, and VHC slumped by 2.06 percent.

Furthermore, the transportation and warehousing stock group also saw significant declines. HAH fell by 2.27 percent, PVT plummeted by 2.68 percent, VSC dived by 1.58 percent, and GMD submerged by 1.52 percent.

At the market close, the VN-Index decreased by 10.23 points, or 0.03 percent, to 1,266.91 points, with 291 stocks declining, 173 advancing, and 50 remaining unchanged. In contrast, the HNX-Index on the Hanoi Stock Exchange rose by 1.86 points, or 0.3 percent, to 245.15 points, with 88 stocks gaining, 80 losing, and 64 holding steady.

Strong selling pressure boosted trading volume significantly, with total transactions on the HOSE nearing VND28.1 trillion, up over VND4 trillion compared to the previous session.

Foreign investors maintained their robust net selling trend for the fifth consecutive session on the HOSE, with total net sales amounting to nearly VND857 billion. Among these, the two most heavily sold Vingroup stocks were VHM, with nearly VND128 billion, and VIC, with nearly VND114 billion. Following closely were HPG, with nearly VND81 billion, VNM, with nearly VND80 billion, FPT, with nearly VND76 billion, and VRE, with over VND55 billion.