Although the VN-Index closed above the reference level, surpassing 1,130 points, the market was “green on the outside, red on the inside.”

On January 2, the Vietnamese stock market opened strongly, but profit-taking by both domestic and foreign investors caused the VN-Index to drop below the reference point before rebounding by nearly 2 points at the session's close. The VN-Index maintained the green color, primarily driven by banking stocks. Despite the increase, the market showed a tendency toward the red side.

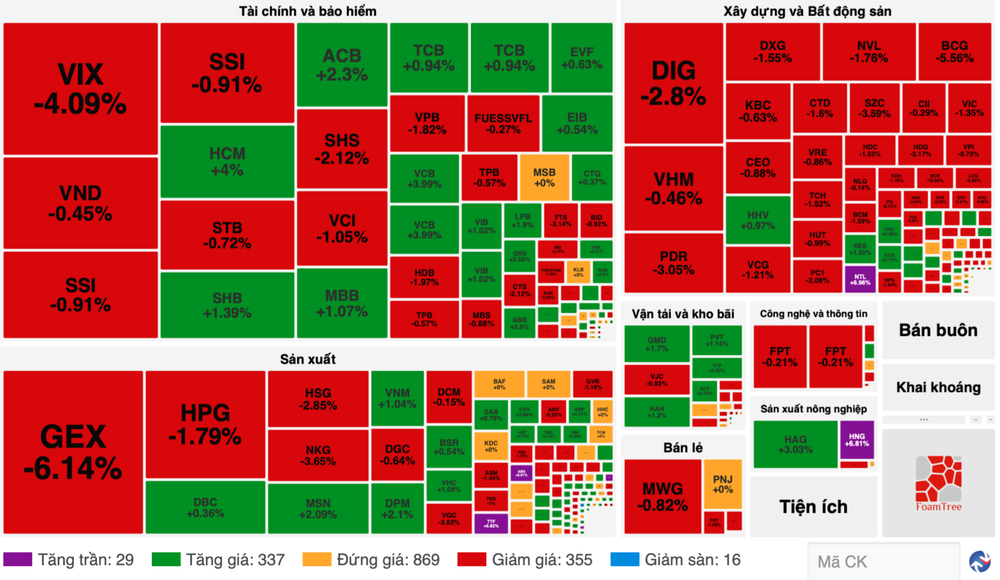

The real estate and construction stock group dropped sharply. Specifically, BCG plunged by 5.56 percent, PDR by 3.05 percent, DIG by 2.8 percent, SZC by 3.59 percent, HDC by 1.53 percent, HDG by 2.17 percent, TCH by 1.52 percent, and NVL by 1.76 percent. Vingroup's trio also simultaneously fell, with VIC losing by 1.35 percent, while VHM and VRE retreating by nearly 1 percent. In contrast, NTL stock surged to its daily limit.

Within the securities stock group, only a few stocks managed to sustain gains, with HCM jumping by 4 percent, ORS by nearly 1 percent, while the rest faced slumps. Particularly, VIX declined by 4.09 percent, SHS by 2.12 percent, FTS by 3.14 percent, BSI by 2.74 percent, VCI by 1.05 percent, and CTS by 2.12 percent.

The banking stocks, the only stock group leaning towards the green, played a key role in keeping the VN-Index in positive territory. Expressly, VCB increased by 3.99 percent, ACB by 2.3 percent, SHB by 1.39 percent, LPB by 1.9 percent, MBB by 1.07 percent, and VIB by 1.02 percent. Meanwhile, CTG, EIB, TCB, and SSB all saw gains of nearly 1 percent.

Conversely, many stocks in the manufacturing group saw steep drops, with GEX slashing by 6.14 percent, NKG by 3.65 percent, HSG by 2.85 percent, HPG by 1.79 percent, VGC by 3.18 percent, and GVR by 1.18 percent.

At the end of the trading session, the VN-Index rose by 1.79 points, or 0.16 percent, to reach 1,131.72 points, with 197 gaining stocks, 299 losing stocks, and 77 unchanged stocks.

Meanwhile, on the Hanoi Stock Exchange (HNX), the HNX-Index reduced by 1.05 points, or 0.45 percent, to close at 229.99 points, with 78 stocks advancing, 75 stocks declining, and 80 stocks remaining unchanged. Market liquidity showed improvement, with the total trading value on the HOSE reaching around VND17.2 trillion.

Following three consecutive net buying sessions at the end of 2023, foreign investors resumed net selling, with a total net selling value of nearly VND355 billion on the HOSE.