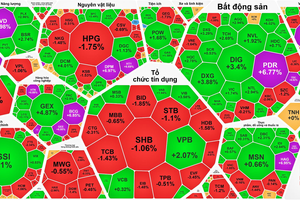

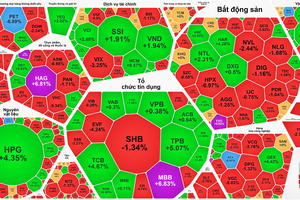

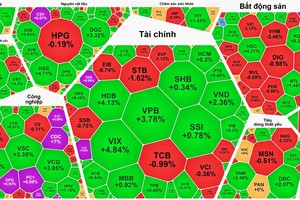

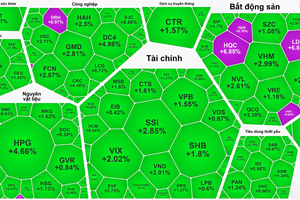

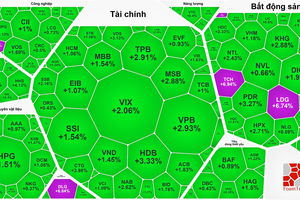

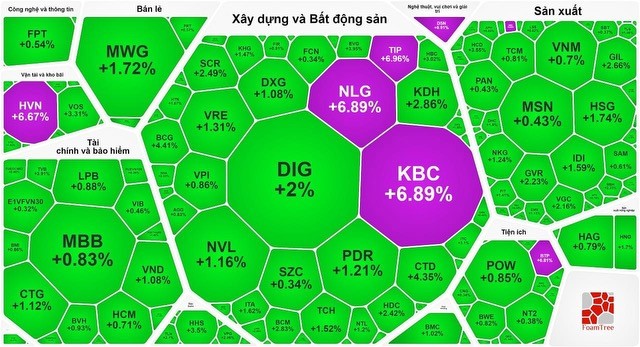

Specifically, the real estate stock group attracted significant capital, resulting in more appearance of purple.

During the trading session on March 4, the stock market, with HOSE reporting nearly US$1.2 billion in trading value, saw a significant influx of funds, driving up stock prices and pushing the VN-Index to sometime surge by almost 10 points. Despite the VN-Index failing to maintain the highest increase level due to profit-taking pressure, it still reached its peak for the year 2024.

The real estate and construction sector rallied robustly as KBC, NLG, and TIP hit their daily limit increases; HDC soared by 2.42 percent, KDH surged by 2.86 percent, BCG skyrocketed by 4.41 percent, BCM climbed by 2.83 percent, DIG advanced by 2 percent, PDR gained 1.21 percent, NVL increased by 1.16 percent, VRE rose by 1.31 percent, NTL improved by 1.25 percent, and DXG edged up by 1.08 percent.

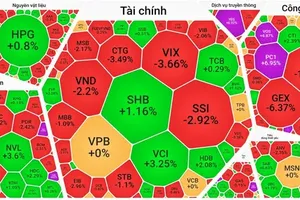

The banking sector showed differentiation. However, losing stocks outnumbered winning ones, suffering sharp declines. Specifically, VCB dropped by 1.34 percent, TPB sank by 1.26 percent, and MSB reduced by 1.27 percent; SSB, STB, and SHB also saw nearly a 1 percent decrease. In contrast, CTG rose by 1.12 percent, while MBB, LPB, EIB, and VIB edged up by almost 1 percent.

The securities stock group also experienced divergence and traded within a narrow range, with BSI, SSI, CTS, OGC, TVS, and VDS sliding by nearly 1 percent; on the other hand, VND emerged by 1.08 percent, while SHS and HCM inched up by almost 1 percent.

The manufacturing stock group saw positive trading activity, with TNG jumping by 4.67 percent, GIL escalating by 2.66 percent, GVR climbing by 2.23 percent, VGC hiking by 2.16 percent, HSG growing by 1.74 percent, and NKG edging up by 1.24 percent. Additionally, in the transportation stock group, HVN surged by hitting the daily limit increase, while VOS soared by 3.31 percent.

At the close of the trading session, the VN-Index climbed by 3.13 points, or 0.25 percent, to reach 1,261.4 points, with 276 stocks rising, 190 stocks falling, and 90 stocks holding steady.

Closing at the Hanoi Stock Exchange, the HNX-Index also enhanced by 0.97 points, or 0.4 percent, to reach 237.38 points, with 114 stocks gaining, 63 stocks declining, and 70 stocks remaining unchanged.

Market liquidity improved significantly, with the total trading value on the HOSE alone reaching nearly VND28.6 trillion (approximately $1.2 billion), up by about VND2.4 trillion compared to last weekend.

Foreign investors continued their net buying streak for the second consecutive session on the HOSE exchange, with a total net buying value of nearly VND102 billion.