The draft Corporate Income Tax Law stipulates that press agencies' income from print media activities is subject to a 10-percent tax rate, and other activities a 15-percent rate. These are more preferential rates compared to applicable regulations, at 10 percent for print media and 20 percent for other activities. However, through discussions with leaders of numerous press agencies, these preferential tax rates in the current context are inadequate and hold little significance.

Editor-in-Chief Ly Viet Trung of Phu Nu Newspaper-HCMC shared that the primary mission of press agencies remains political in nature to propagandize policies and directives of the Central Party and the State.

Press agencies generate revenue to sustain their operations in fulfilling political duties, rather than pursuing the paramount objective of profit maximization and budget contributions like regular businesses. Therefore, subjecting press agencies to the same tax treatment as regular businesses is inequitable.

What is more, current regulations (or according to the draft Corporate Income Tax Law) that differentiate tax rates between print media and other forms of press are also problematic. For instance, content published in print media is often republished on electronic platforms, creating an overlap between different forms. Such classification also poses challenges for tax authorities. Therefore, implementing a unified 10-percent tax rate for all profits generated from press agency activities would be reasonable.

Editor-in-Chief Ly Viet Trung stressed that while the draft law provides a preferential 10-percent Corporate Income Tax rate for print media activities, print media is currently operating at a loss, generating no taxable profit.

This has urged them to engage in extra activities to compensate for print media revenue, such as building rentals and event communications for various entities, which yield modest profits - and are subject to a 20-percent tax rate, meaning press agencies are treated as regular businesses. The tax rate reduction from 20 percent to 15 percent, though more preferential, remains inadequate and warrants consideration for a more reasonable rate.

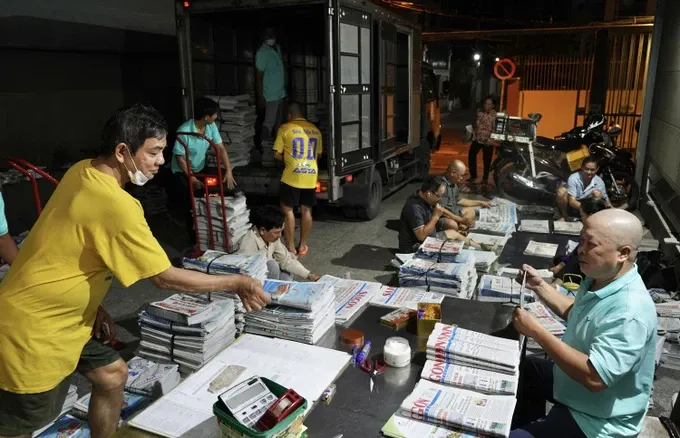

Reflecting on the “history” of tax preferences for press agencies, Deputy Editor-in-Chief Dinh Minh Trung of Tuoi Tre Newspaper noted that the 2008 Corporate Income Tax Law contained no tax preference provisions for press agencies. Subsequently, the explosion of social media, followed by changes in businesses’ and advertising companies’ communication methods, caused press agencies to face numerous difficulties, declining circulation, and reduced income.

The 10-percent tax preference for print media, implemented in the 2013 amended Corporate Income Tax Law, has become less effective due to declining print circulation and rising digital competition. Deputy Editor-in-Chief Dinh Minh Trung, therefore, suggests applying a 10-percent tax rate to all press agency revenue sources. This would provide essential resources for operations, staff, and reinvestment, ensuring the sustainability of the press industry.

According to Deputy Editor-in-Chief Bui Thanh Liem of Nguoi Lao Dong Newspaper, the emergence of social media has significantly impacted the revenue of press agencies. Traditional print media has faced declining advertising revenue, forcing agencies to adapt to the digital age. To remain competitive, they are investing in digital platforms (Facebook, YouTube) and content. A reduced Corporate Income Tax to 10 percent for all forms of press would be beneficial, providing essential support for the industry's sustainability.

Deputy Editor-in-Chief Bui Thi Hong Suong of SGGP Newspaper commented that to support media agencies, a unified tax rate should be applied across all activities except public asset leasing under Government Decree 151/2017/ND-CP on public asset management and use. A 5-percent rate for print media and 10-percent one for other activities is proposed.

Media agencies that self-finance can pay additional salaries and wages, treated as reasonable expenses when determining taxable income for Corporate Income Tax. This requires consistent regulations to avoid compliance issues during inspections.

In other words, they should be allowed to pay salaries and income to staff, reporters, and employees like the business model, provided they can ensure balanced revenue and expenditure. In this case, regulations need to be supplemented to ensure consistency between decrees, circulars, and related documents to avoid violations during functional agency inspections, checks, or state audits.

Besides Corporate Income Tax, currently, input Value Added Tax (VAT) is deductible based on the ratio of taxable revenue to non-taxable revenue, as print media circulation is VAT-exempt; advertising, sponsorship, and other activities are subject to 8 percent VAT; non-deductible VAT must be counted as expenses, causing increased costs, reduced revenue-expenditure difference, affecting the organization's overall operations. Therefore, SGGP Newspaper proposes that self-sufficient press agencies in regular expenditure should be eligible for full input VAT deduction.