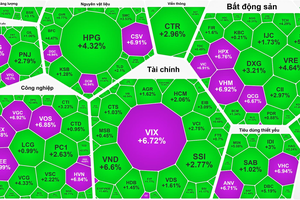

In recent reports, HSBC and CitiGroup recommended the Vietnamese stock market as one with good prospects for growth to tempt investors into believing that the market was recovering. These reports came two months after HSBC and Merrill Lynch had delivered gloomy prognostications for the local market.

Big-time selling because of a report

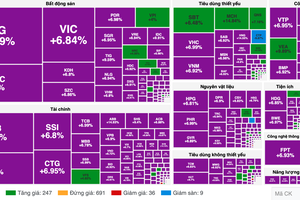

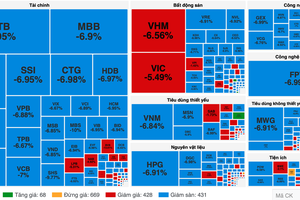

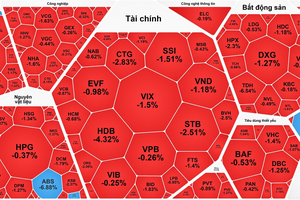

HSBC’s report released two months ago predicted the VN-Index would fall below 900 points by the end of the year. Almost on cue, the index shed more than 50 points as investors took the prediction seriously.

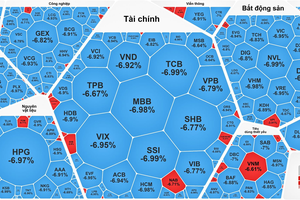

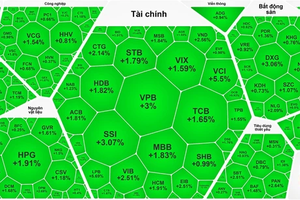

Soon after, HSBC spent nearly USD33.7 million buying more shares of the state-owned bank Techcombank (TCB), increasing its holding from 10 percent to 15 percent. It even sought the Vietnamese government’s approval to buy a further five percent of TCB.

Similarly, Merrill Lynch’s reports on July 5 advised staying away from Viet Nam’s stock market. The investment house said it wasn’t trying to alarm investors, but the trading volume of foreign investors in the Vietnamese market promptly nosedived anyway.

A survey found that the difference between foreign buying and selling of listed stocks had dropped to US$81 million two months after the report came out, a decline of nearly one third.

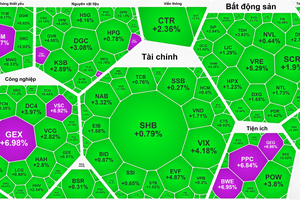

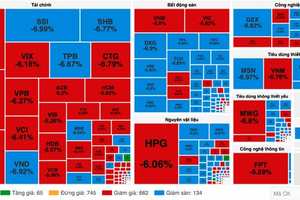

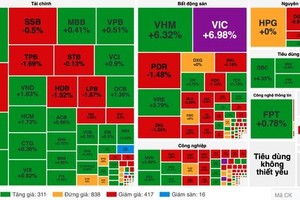

Local investors became reluctant to buy more shares as they watched the foreigners reduce their buying, and so the VN-Index began its long descent from more than 1,050 points at the end of June to 891 in the middle of August.

Time to buy

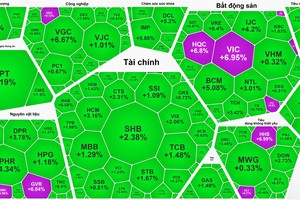

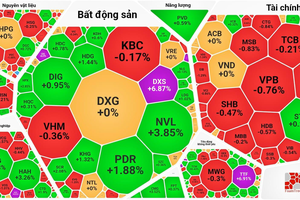

Citigroup recently opined that Viet Nam’s steady economy would be unaffected by the turmoil in Asian stock markets following the collapse in the US sub-prime mortgage business.

According to the Ministry of Planning and Investment, industrial product sales in the first eight months rose more than 17 percent year-on-year and foreign direct investment in the first seven months increased by 49 percent year-on-year.

Citigroup predicts that Viet Nam’s inflation rate will fall below eight percent and be under the estimated GDP growth this year, and that the nation’s foreign currency reserves will be 60 percent greater than in 2006. The US bank is heavily invested in the Vietnamese stock market and says it is impressed by the country’s steadily growing economy.

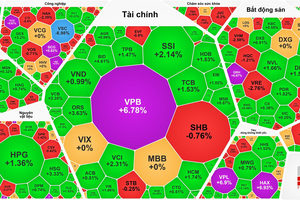

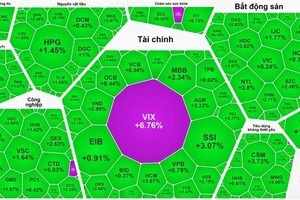

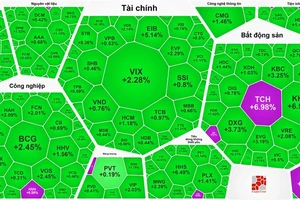

Citigroup Global Market Ltd. and Citigroup Global Market Financial Products Ltd., which act on their parent’s behalf, are busy buying as much of big cap stocks like Saigon Hotel (SGH), Tan Tao Industrial Zone (ITA), Kinh Do Food (KDC) and North Kinh Do (NKD) as they can.

Similarly, Dragon Capital Group – the largest and most experienced portfolio investor in Viet Nam – was a keen seller of the sought-after stock Tay Ninh Cable Car (TNC) but kept on buying Cotec Construction (Coteccons) and Nam Viet Seafood (Navico) in the OTC market.

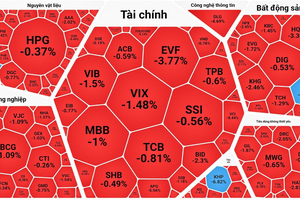

HSBC’s report on August 29 said investors should think twice before buying Vietnamese stocks despite the economy’s strength. The report said that the earnings-per-share (EPS) of listed Vietnamese companies were surging and pointed out that the net first-half profit of the dozen largest market caps had risen by 83 percent year-on-year, and their average EPS by 35 percent.

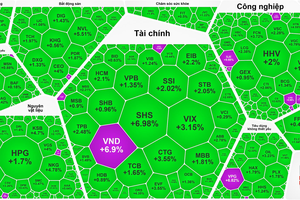

Though the foreign institutions seemed unwilling to buy Vietnamese stocks recently, share prices are starting to climb in some cases. Because of these pessimistic reports, they indirectly caused the VN-Index to languish around the 900 level before moving back in big-time to tempt local investors back into the market and push prices up again.

Conceivably, foreign investors pretended they didn’t want to take risks with the Vietnamese stock market, all the while buying shares that were becoming cheaper by the day.

Just as the locals were losing all faith and the index was reflecting this sentiment, the foreign investment houses shrugged off their pessimism and began extolling the virtues of Viet Nam’s stock market.

Both Citibank and HSBC reckoned the market would pick up steam after the break for Independence Day, and today’s showing at the local bourse is bearing them out.