|

Foreign investors continued to sell nearly VND444 billion on the HOSE exchange.

The Vietnamese stock market attracted significant capital inflows during the trading session on May 31, but the VN-Index saw a slight decrease due to heavy selling pressure on blue-chip stocks. Within the VN30 basket, there were 19 declining stocks, eight advancing stocks, and three stocks remaining unchanged. The stocks that retreated included PLX, SSI, VCB, VHM, VIC, VJC, VRE, VPB, TCB, HDB, MSN, BVH, GVR, HDB, and MBB.

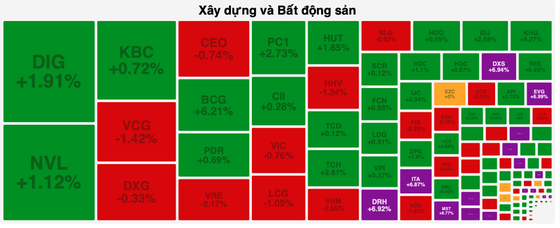

Meanwhile, the group of small and mid-cap stocks, particularly small real estate stocks, continued to show strong growth. Stocks like DXS, DRH, ITA, LGL, QCG, TDH, and CRE reached their daily limit.

On the other hand, large-cap real estate stocks, especially the VinGroup trio, all slumped, with VHM falling by 2.55 percent, VIC sliding by 0.76 percent, and VRE dropping by 2.17 percent.

The retail sector, which had performed well in the previous session due to the positive impact of the 2-percent reduction in value-added tax, reversed course and declined in today's session, with MWG dipping by 0.51 percent, PNJ trimming by 0.28 percent, and FRT reducing by 1.85 percent.

At the close of the trading session, the VN-Index shrank by 2.88 points, or 0.27 percent, to 1,075.17 points, with 225 winners, 167 losers, and 56 unchanged stocks. Meanwhile, on the Hanoi Stock Exchange, the HNX-Index rose by 1.48 points, or 0.67 percent, with 130 stocks gaining, 61 stocks declining, and 142 stocks remaining unchanged.

Market liquidity remained high, with a total trading value of over VND17.7 trillion on the two main exchanges.