|

Vietnam’s stock market took place cautiously in the trading session on June 30 due to investors' apprehension following a significant decline in the previous session. The cash flow into the market was limited as investors mostly remained on the sidelines to observe, leading to a notable decrease in liquidity.

The market opened with a slight increase in the VN-Index but later turned downward as selling pressure consistently outweighed purchasing power. As the trading session progressed, the market experienced further declines and closed at 1,120 points.

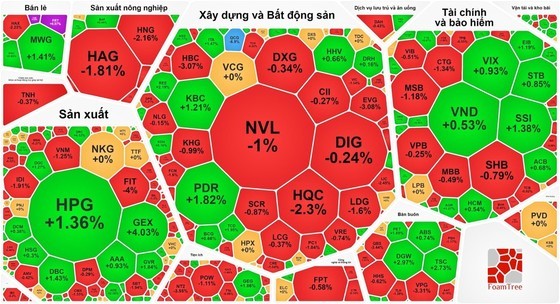

However, there was a differentiation among stock groups rather than a uniform trend toward one side. Specifically, in the banking sector, VCB declined by 1.86 percent, BID experienced a drop of 2.58 percent, CTG saw a decrease of 1.34 percent, VPB recorded a decline of 0.25 percent, TCB witnessed a dip of 0.92 percent, and MBB registered a slight decrease of 0.49 percent. On the other hand, ACB showed an increase of 0.68 percent, HDB rose by 1.36 percent, STB climbed by 0.85 percent, SSI advanced by 1.38 percent, and EIB gained 1.19 percent.

Similarly, real estate stocks saw QCG hitting the floor, VRE dropping 0.74 percent, NVL falling 1 percent, DIG tripping 0.24 percent, NLG sliding 0.15 percent while KBC mounting 1.21 percent, KDH edging up 0.16 percent, PDR strengthening 1.82 percent, and LGC soaring 5.28 percent.

The securities group alone had a positive recovery session, with SSI increasing by 1.38 percent, VND rising by 0.53 percent, VCI climbing by 0.83 percent, HCM gaining 0.54 percent, VIX advancing by 0.93 percent, FTS growing by 0.87 percent, and BSI experiencing a rise of 0.62 percent.

Furthermore, retail stocks experienced a significant surge in this trading session following the official announcement of a VAT reduction to 8 percent starting from July 1. Notably, FRT reached the upper limit, MWG rose by 1.41 percent, PET increased by 1.9 percent, and DGW surged by 3 percent.

By the end of the trading session, the VN-Index recorded a decline of 5.21 points, or 0.46 percent, to settle at 1,123.13 points. The market witnessed 249 stocks in decline, 167 stocks in advance, and 92 stocks remaining unchanged.

The HNX-Index of the smaller bourse in the North reduced 0.16 points, or 0.07 percent, to close at 227.32 points with 70 winners, 107 losers, and 155 unchanged stocks.

Market liquidity significantly declined, with the total trading value reaching approximately VND14.2 trillion.