|

The Vietnam stock market recovered sharply in the trading session on March 8, while the global stock market fell.

In the morning session, the US stock market dropped steeply after the US Federal Reserve announced to continue raising interest rates, causing the supply in the market to increase strongly because of investors' concerns. The number of losing stocks dominated the market, with key stock groups dropping, making the VN-Index close the morning session with a decrease of nearly 5 points.

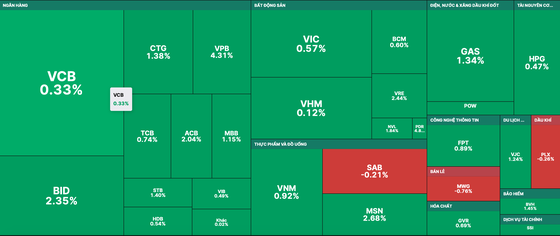

However, in the afternoon, the cash flow entered the market and accepted to buy shares at high prices, so several stocks quickly made a U-turn, with blue chips contributing significantly to the VN-Index's gain. Specifically, BID increased by 2.35 percent, VPB jumped by 4.31 percent, MSN rallied by 2.68 percent, GAS gained by 1.34 percent, and CTG edged up 1.38 percent.

Besides, public investment and real estate stocks also rebounded strongly. Specifically, LCG hit the ceiling, VCG added up 4.48 percent, HHV enlarged by 4.51 percent, and FCN rose by 3.6 percent. Among real estate stocks, DXG hit the ceiling, PDR grew by 4.87 percent, SCR advanced by 3.67 percent, and NVL went up by 1.85 percent.

In addition, banking and securities stocks also had many stocks that climbed by more than 3 percent.

Closing the session, the VN-Index revived 11.34 points, or 1.09 percent, to 1,049 points, with 256 gainers, 123 losers, and 116 unchanged stocks. On the smaller bourse in the North, the HNX-Index also mounted 1.18 points, or 0.57 percent, to close at 208.68 points, with 89 winners, 57 losers, and 196 unchanged stocks.

Although market liquidity improved compared to previous sessions, it was still below VND10 trillion. The total trading value on the two official exchanges was about VND9.4 trillion. Foreign investors continued to be net buyers for the second consecutive session, with nearly VND264 billion on the HoSE and the HNX.