|

Due to cautious investors, market liquidity was low on both official exchanges, with a total trading value of less than VND9 trillion. Cash flow did not enter the market while the selling pressure remained high, causing the VN-Index to officially fall below the support level of 1,060 points after a prolonged struggle.

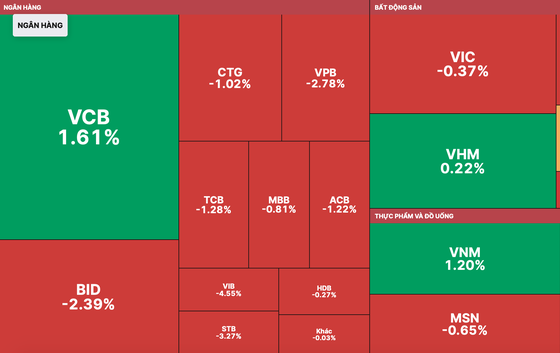

Vietnam's stock market was volatile in the morning trading session on February 10 due to investor caution. In the afternoon session, selling pressure increased, leading to widespread losses. Banking, securities, real estate, and public investment stocks all declined, pulling the VN-Index down by nearly 9 points.

In particular, banking stocks saw steep drops, such as EIB falling to the floor, VIB falling by 4.5 percent, STB down by 3.3 percent, TPB declining by 2.9 percent, VPB retreating by 2.8 percent, and BID losing 2.4 percent. Securities stocks also declined, with VCI down 2.2 percent, HCM down 1.5 percent, VDS down 3 percent, BSI down 2.7 percent, CTS down 2.5 percent, FTS down 2.1 percent, VND down 2.8 percent, SSI down 1.8 percent, and VIX down 3.6 percent. Real estate and public investment stocks also dropped, such as DXG by 5.7 percent, DIG by 4.1 percent, LCG by 3.3 percent, KBC by 5.3 percent, VCG by 2.8 percent, and HHV by 3.2 percent. Especially, KHG hit the floor.

At the close of the trading session, the VN-Index was down 8.73 points, or 0.82 percent, to 1,055.3 points, with 306 losing stocks, 93 gaining stocks, and 111 unchanged stocks.

The HNX-Index also fell 2.42 points, or 1.15 percent, to 208.5 points, with 116 losing stocks, 54 gaining stocks, and 172 unchanged stocks, closing the session in Hanoi.

Market liquidity was extremely poor, with the total trading value on both exchanges at VND 8.92 trillion. Foreign investors made a net purchase of VND54 billion on the HoSE and HNX.