In the stock market's last session of the week on January 5, trading was quite active, and the cash flow continued to pour into banking stocks, contributing to the VN-Index's fourth consecutive increase since the beginning of the week. Meanwhile, foreign investors strengthened their net selling positions, marking the fourth straight session of net selling with a total net selling value on the HOSE of nearly VND420 billion.

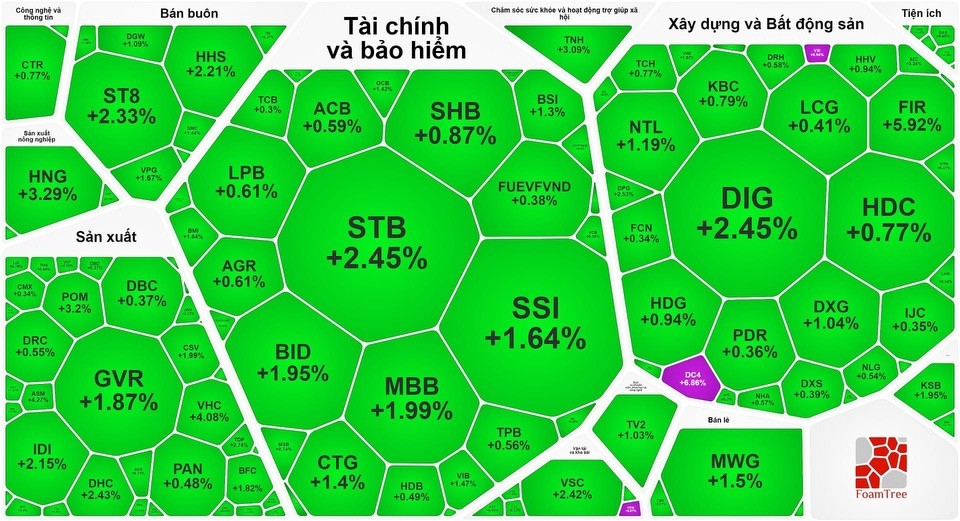

The banking stocks continued their positive trend, with STB soaring by 2.45 percent, BID climbing by 1.95 percent, OCB adding up by 1.42 percent, VIB gaining by 1.47 percent, and CTG rising by 1.4 percent. Other stocks like TPB, VCB, HDB, SHB, and LPB also posted a nearly 1 percent increase.

Securities group maintained its reference price level with slight gains. Specifically, SSI surged by 1.64 percent, BSI advanced by 1.3 percent, while ARG and VCI saw an uptick of nearly 1 percent. Meanwhile, VND, SHS, and VIX kept their reference prices.

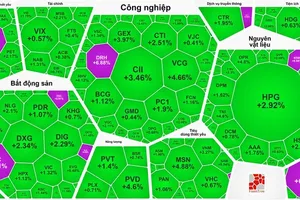

In the real estate and construction group, there is a divergence. DIG hiked by 2.45 percent, DXG enlarged by 1.04 percent, SZC escalated by 3.19 percent, and DPG jumped by 2.53 percent. Stocks like KBC, CEO, PDR, NLG, HHV, TCH, HUT, HDG, and KDH all gained by 1 percent. Conversely, CII decreased by 1.16 percent, ITA dropped by 1.36 percent, HQC declined by 1.83 percent, and VRE, VIC, and BCM slid by nearly 1 percent.

The VN-Index rose by 3.96 points, or 0.34 percent, to wrap week at 1,146.68 points, with 221 stocks experiencing gains, 267 stocks facing declines, and 95 stocks maintaining their values.

On the Hanoi Stock Exchange, the HNX-Index also saw a modest increase of 0.20 points, or 0.09 percent, to reach 232.76 points, with 70 stocks on the rise, 79 stocks in decline, and 90 stocks unchanged.

Liquidity devalued sharply, with the total trading value on HOSE was about VND16.3 trillion, down VND9 trillion compared to the previous session.