Shares of Quoc Cuong Gia Lai (QCG) continued to hit the floor for the second consecutive session, falling to VND8,440 per share. Nearly 6.1 million shares remained unsold at the floor price, with no buyers in sight.

On July 22, the stock market saw a sharp sell-off at the start of the session, with liquidity surging and the VN-Index dropping by as much as 20 points. However, by the end of the session, supply dwindled and demand returned, helping the VN-Index to reduce its decline to just over 10 points by the close.

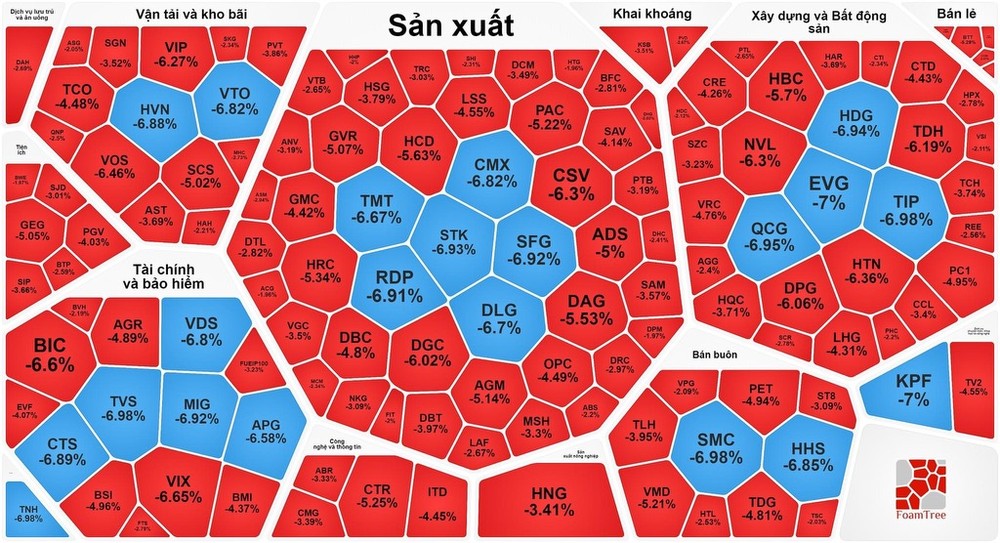

The securities sector saw a significant decline, with many stocks hitting the floor or approaching it: CTS, VDS, and TVS hit the floor price; VIX fell by 6.65 percent, MBS plunged by 6.78 percent, BSI slumped by 4.96 percent, FTS dropped by 2.79 percent, and AGR declined by 4.89 percent.

The banking sector exhibited mixed results. TCB rose by 1.07 percent, HDB emerged by 1.4 percent, and TPB advanced by 1.09 percent; CTG, MSB, VCB, SSB, and OCB increased by nearly 1 percent. In contrast, LPB lost by 1.4 percent, EIB weakened by 1.34 percent, and MBB, STB, SHB, and VIB slid by nearly 1 percent.

The real estate and construction sector continued its negative trend. Besides QCG, stocks like HDG, EVG, and TIP hit the floor price; NVL demolished by 6.3 percent, CTD collapsed by 4.43 percent, TCH crumbled by 3.74 percent, DPG tumbled by 6.06 percent, and SZC narrowed by 3.23 percent.

In the manufacturing sector, a few stocks managed to show gains. SBT climbed by 2.7 percent, and MSN rallied by 1.69 percent; VNM, SAB, and TCM gained by nearly 1 percent, while the rest saw declines. Among the decliners, several experienced sharp drops. GVR was slashed by 5.07 percent, DGC was reduced by 6.02 percent, DBC was cut by 4.8 percent, and ANV was chopped by 3.19 percent.

The information technology and oil and gas sectors also continued their downward trend. CTR sank by 5.25 percent, CMG lowered by 3.39 percent, and FPT retreated by 1.51 percent; BSR shrank by 3.06 percent, PVS minimized by 3.07 percent, and PVD went down by 2.67 percent.

At the close of the trading session, the VN-Index dropped by 10.14 points, or 0.8 percent, to 1,254.64, with 350 stocks declining, 96 advancing, and 53 remaining unchanged. On the Hanoi Stock Exchange, the HNX-Index also fell by 2.14 points, or 0.89 percent, to 238.38 points, with 118 stocks declining, 60 rising, and 55 standing still.

Liquidity surged, with the total trading value on the HOSE reaching over VND21.1 trillion, up VND3.4 trillion from the previous week’s final session.

In this ongoing sharp market decline, foreign investors returned to net buying, with nearly VND440 billion on the HOSE. Their purchases were concentrated in SBT with nearly VND376 billion, FPT with nearly VND62 billion, and POW with nearly VND34 billion. They also bought several other stocks, including VND with nearly VND31 billion, SSI with nearly VND29 billion, and FTS with nearly VND25 billion.

*Mien Tay Bus Station reports over VND20 billion profit for Q2 2024

According to the Q2 2024 financial report, Mien Tay Bus Station Joint Stock Company (stock code: WCS) achieved total revenue of over VND40 billion, with nearly VND40 billion coming from business operations, up 14.7 percent year-on-year.

This growth is attributed to the addition of several new transportation companies registering to operate routes at the station. Additionally, the station expanded the number of new routes and increased the bus schedules during the peak periods around the April 30 and May 1 holidays. Mien Tay Bus Station also adjusted its service fees for vehicle parking and the number of transit buses entering and leaving the station.

Revenue increased significantly while operating costs rose slightly by 1.74 percent compared to the same period last year. Consequently, WCS achieved a net profit of over VND20 billion for Q2 2024, a 22.98 percent increase from 2023, the highest profit level since 2015.

For the first half of the year, the company reported cumulative revenue of nearly VND79 billion, up 15 percent from the same period in 2023. This performance means WCS has already accomplished half of its annual business target.