Amid concerns about inflationary pressure as the US Federal Reserve (FED) will decide to raise interest rates sharply again next Wednesday, Vietnam's stock market reacted as negatively as the world stock market on the first trading session of the week.

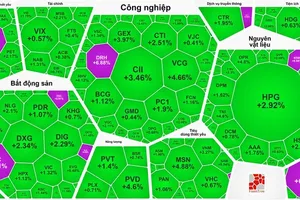

The selling force appeared at the beginning of the trading session, causing large-cap stocks to drop sharply. Specifically, GVR dropped 2 percent, VRE fell 2.2 percent, CTG declined 1 percent, and MBB and VNM slid nearly 1 percent. Although three blue-chip stocks, consisting of GAS, SAB, and VIC, managed to keep the green color on the market but could not prevent the index from plunging. Securities pilot stocks, such as VCI, VND, HCM, and SSI, also dropped steeply, so it negatively affected the index.

In the afternoon trading session, the selling-off momentum was getting bigger and bigger, pushing down a series of securities, real estate, steel, fertilizer, and oil and gas stocks. Specifically, PVD, GVR, VCI, HSG, NKG, DCM, DPM, CII, HAH, DGW, SZC, PET, SCR, and CII fell to floor prices. Insurance and banking stocks also plummeted heavily. For instance, MIG hit the floor, BVH slumped 5.2 percent, TPB sank 4.9 percent, STB weakened 3.8 percent, and MBB lost 3.7 percent. As a result, the VN-Index dropped to the lowest level in the trading session after losing more than 28 points.

Foreign investors net bought about VND149 billion on the HoSE in this trading session.

Ending the session, the VN-Index nosedived 28.6 points, or 2.32 percent, to 1,205.43 points, with 64 gainers, 399 losers, and 42 unchanged stocks. Closing the session on the Hanoi Stock Exchange, the HNX-Index plunged 8.63 points, or 3.16 percent, to 264.25 points, with 51 winners, 162 losers, and 34 unchanged stocks. Market liquidity increased slightly by nearly 4 percent compared to the last trading session of last week, with the total trading value reaching VND17.38 trillion.