At the close of trading session, the stock market unexpectedly experienced a sharp decline, triggering widespread selling pressure throughout the market and causing the VN-Index to plummet uncontrollably, with numerous stocks hitting their lower limits. In total, 143 stocks saw maximum drops on both the HOSE and HNX exchanges.

The stock market on April 15 witnessed panicked selling by investors. Not only domestic investors, but foreign investors also engaged in sell-offs, with net selling value on the HOSE exchange reaching nearly VND1.24 trillion, contributing substantial pressure, leading to a freefall of nearly 60 points in the VN-Index.

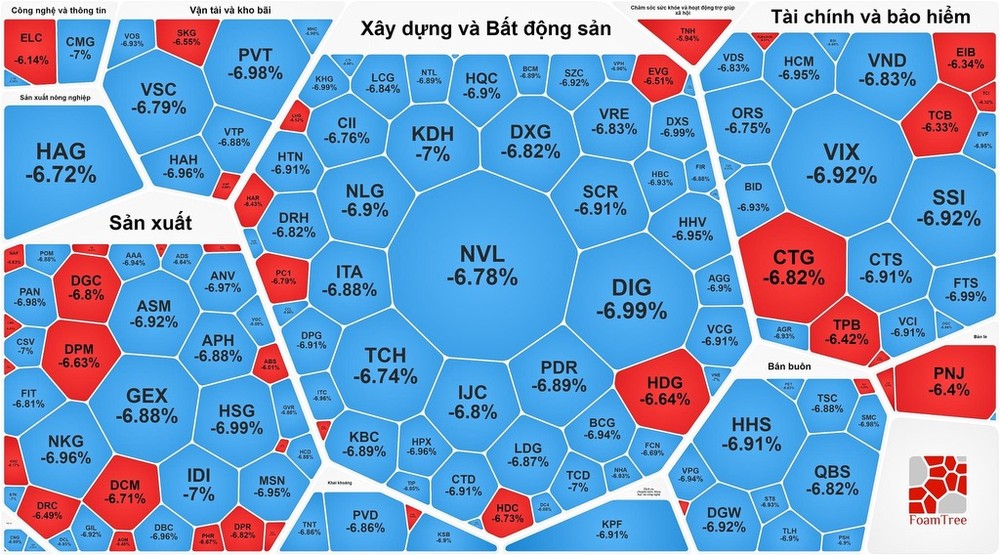

The real estate and construction sector saw the most stocks hitting their lower limits, including NVL, KBC, CII, HHV, VCG, DIG, PDR, TCH, NLG, VRE, FCN, LCG, DXG, KDH, CTD, BCM, and SZC. Many of these stocks closed the session with no buyers on the market.

In the banking sector, BID hit its lower limit, while MBB dropped by 5.07 percent, CTG slashed by 6.82 percent, and TCB plunged by 6.33 percent. VPB dived by 5.58 percent, STB reduced by 5.5 percent, and TPB slumped by 6.42 percent.

Similarly, in the securities sector, stocks like VIX, VCI, SSI, HCM, VND, CTS, FTS, BSI, BVS, AGR, and VDS all hit the floor.

Additionally, many stocks in the manufacturing sector, such as HSG, NKG, MSN, GEX, DBC, and GVR, as well as those in the oil and gas sector like PVC, PVD, and PVT, and transportation and warehouse stocks like VSC, VTP, and HAH, also hit the daily limit losses.

Closing the trading session, the VN-Index plunged by 59.99 points, or 4.7 percent, to 1,216.61 points, with 475 stocks declining (including 112 hitting their floor prices), 40 advancing, and 30 remaining unchanged.

Similarly, on the Hanoi Stock Exchange, the HNX-Index sank by 11.63 points, or 4.82 percent, to 229.71 points. Among listed stocks, 172 dropped (including 31 hitting their floor prices), 35 climbed, and 38 stood still.

Trading volume saw a sudden increase, with the total trading value on the HOSE reaching nearly VND33.6 trillion, up by nearly VND10 trillion compared to the previous session. If the entire market is considered, liquidity amounts to roughly VND38 trillion.