|

Furthermore, foreign investors continue to sell off aggressively, causing the market to lose support.

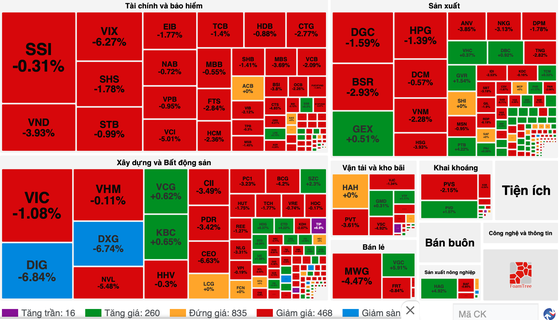

On October 5, Vietnam's stock market witnessed investors adopting a cautious stance, with many holding onto their funds and refraining from investing in stocks. Key blue-chip stocks experienced significant declines, exerting downward pressure on the index. With only eight pillar stocks, namely VCB, BID, CTG, GAS, VNM, MWG, PLX, and HPG, posting sharp drops, the VN-Index lost nearly 9 points.

Real estate stocks continued to plummet, with DXG, DIG, and NBB hitting floor limits, while NVL plunged by 5.48 percent, DXS fell by 4.48 percent, PDR retreated by 3.42 percent, NLG collapsed by 3.31 percent, CII slumped by 3.49 percent.

Banking stocks also declined significantly, with a few exceptions like LPB and SSB, which increased by nearly 1 percent. However, other stocks such as CTG dropped by 2.77 percent, VCB sank by 2.09 percent, TCB lowered by 1.4 percent, MSB slid by 1.45 percent, and VIB reduced by 2.12 percent.

Securities stocks continued to move downward. Specifically, VND tumbled by 3.93 percent, VCI slumped by 5.01 percent, HCM shrank by 2.36 percent, VIX dived by 6.27 percent, FTS diminished by 2.84 percent, BSI descended by 3.8 percent, and CTS evaporated by 4.85 percent. Meanwhile, steel stocks also saw sharp decreases, with NKG sliding 3.13 percent, HSG melting 3.93 percent, and HPG sagging 1.39 percent.

After a modest net buying session the previous day, foreign investors have reverted to net selling, offloading nearly VND724 billion on the HOSE. By the close of the trading session, the VN-Index slashed by 14.78 points, or 1.31 percent, to land at 1,113.89 points, marked by 386 losers, 103 winners, and 56 unchanged stocks.

On the Hanoi Stock Exchange (HNX), the HNX-Index also experienced a drop, falling by 2.19 points, or 0.95 percent, to settle at 228.01 points, featuring 110 declining stocks, 69 advancing stocks, and 58 standing still stocks.

Market liquidity demonstrated a significant decline, with the total trading value across the entire market barely reaching VND15.3 trillion, of which the HOSE market contributed VND13 trillion.