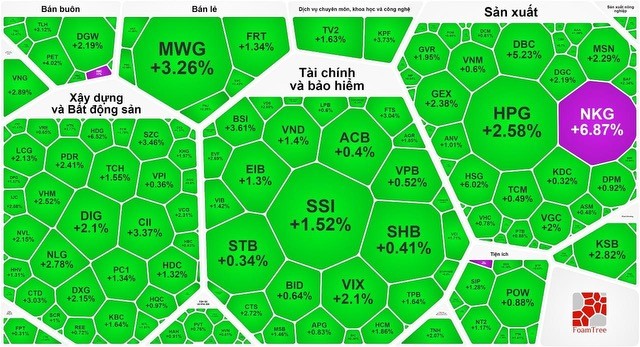

It's worth mentioning that capital has spread across various stock groups, with the steel stock sector playing a significant role.

During the stock market session on January 16, the VN-Index fluctuated around the reference price for the majority of the trading period but concluded with a 9-point increase, driven by heightened buying activity.

The steel stock group was the first to make a breakthrough as it attracted substantial capital. Specifically, NKG hit the daily limit, HSG rocketed by 6.02 percent, HPG rose by 2.58 percent, and POM soared by 5.69 percent.

Meanwhile, the banking stock sector also leaned towards the green, contributing to fortifying the rising momentum in the market, with EIB winning by 1.3 percent, TPB gaining by 1.64 percent, VIB rallying 1.42 percent, and MSB advancing by 1.56 percent. Meanwhile, STB, MBB, ACB, SHB, LPB, and BID all saw increases of nearly 1 percent.

Capital has also returned to the securities stock group, leading to a robust recovery. Among the securities stock group, BSI surged by 3.51 percent, FTS grew by 3.04 percent, CTS climbed by 2.72 percent, VIX emerged by 2.1 percent, SSI shot up by 1.52 percent, SHS enlarged by 1.66 percent, VCI expanded by 1.71 percent, and HCM spiraled by 1.86 percent.

The real estate - construction sector also witnessed significant upward movements. HDG jumped by 6.52 percent, CTD hiked by 3.03 percent, CII escalated by 3.37 percent, HUT enhanced by 3.11 percent, NLG strengthened 2.78 percent, PDR heightened by 2.41 percent, NVL improved by 2.15 percent, DXG widened by 2.15 percent, DIG mounted up 2.1 percent, and CEO edged up by 1.4 percent. The Vingroup trio also performed well, with VHM building up by 2.52 percent and VIC and VRE seeing nearly 1 percent increases.

The retail stock group showed positive trading. In particular, MWG increased by 3.26 percent, DGW rose by 2.19 percent, PN climbed by 2.25 percent, and PET gained 4.02 percent. Furthermore, the manufacturing stock sector saw a strong rebound, with DBC surging by 5.23 percent, BAF adding up 2.34 percent, MSN going up by 2.29 percent, and DGC elevating by 2.19 percent.

Closing the trading session, the VN-Index saw a 9-point increase, or 0.78 percent, to reach 1,163.12 points, with 318 stocks advancing, 163 stocks declining, and 102 stocks maintaining their value. Meanwhile, at the Hanoi Stock Exchange, the HNX-Index also climbed by 1.95 points, or 0.86 percent, to close at 229.5 points, with 94 stocks in the green, 62 stocks in the red, and 67 stocks unchanged.

Although liquidity showed improvement, it remained at a modest level, with the total trading value on the HOSE reaching around VND13.1 trillion.

For the fourth consecutive session, foreign investors maintained their net buying trend on the HOSE, with the total value of their purchases reaching close to VND149 billion.