|

Despite some fluctuations during the trading session, the Vietnamese stock market sustained a positive momentum on May 30, edging closer to the 1,080-point mark. Notably, the pillar stock VCB reversed its course and experienced a robust surge toward the end of the session, contributing 1.7 points to the overall 3-point gain of the VN-Index.

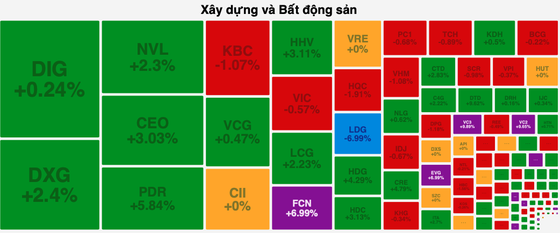

During this trading session, the real estate stock group exhibited active trading and attracted capital inflows, resulting in positive gains. Notably, several real estate stocks, including VRC, QCG, LGL, and TDH, reached the trading limit. PDR saw a 5.8 percent increase, NVL rose by 2.3 percent, CEO climbed by 3 percent, EVG surged by 6.2 percent, NHA experienced a 4.1 percent rise, and HDC and HDG both gained 3.4 percent. Additionally, TDG, ITA, DXG, and FCN recorded increases ranging from 2 percent to nearly 3 percent.

Furthermore, the oil and gas stock group maintained positive momentum, with BSR, OIL, POS, PTV, PVB, PVC, PVD, and PVS all rising by over 1 percent.

In addition to VCB, several blue-chip stocks such as PLX, VRE, CTG, FPT, VPB, MSN, and MWG also experienced gains, contributing to a more than 3-point increase in the VN-Index at the end of the session. However, a drawback was that foreign investors returned as strong net sellers, with a net selling value of nearly VND517 billion on the HoSE.

By the close of the trading session, the VN-Index climbed by 3.07 points to surpass 1,078 points, or 0.29 percent, with 225 stocks increasing, 156 stocks decreasing, and 60 stocks remaining unchanged.

Meanwhile, at the Hanoi Stock Exchange (HNX), the HNX-Index rose by 1.03 points, or 0.47 percent, to reach 221.33 points, supported by 102 stocks gaining, 68 stocks declining, and 74 stocks remaining unchanged.

The market continued to witness an influx of capital, with a significant increase in liquidity. The total trading value on the two main exchanges reached VND18.2 trillion.