|

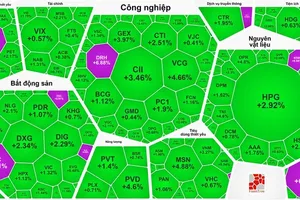

Several real estate stocks were sold off, such as NVL, PDR, DIG, DRH, DXG, and NBB hitting the floor, L14 plunging by 8.54 percent, and CEO sinking by 8.49 percent, causing a negative impact on the market. Public investment stocks also fell sharply. In particular, FCN dropped by 5.5 percent, HHV fell by 4.08 percent, and VCG weakened by 3.11 percent. Along with that, securities stocks, which are always sensitive to the negative movements of the market, also declined steeply. Specifically, VCI crumbled by 6.02 percent, HCM devalued by 4.22 percent, VND went down by 3.93 percent, SSI slid 2.63 percent, and VIX and CTS fell to the floor.

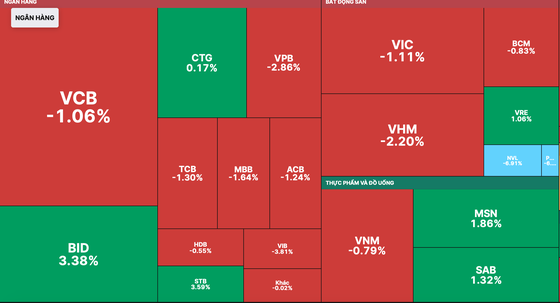

Although the red color still covered the market with the total number of losing stocks on two official exchanges up to 523, of which 67 stocks hit the floor. However, pillar stocks, such as VRE, STB, and BID, recovered robustly in the ATC session, helping the VN-Index to narrow losing momentum, from a drop of nearly 22 points to nearly 12 points at the close, recovering about 10 points from the lowest point in the session.

The VN-Index dropped for a third trading session in a row, reducing 11.6 points, or 1.1 percent, to close at 1,043.7 points, with 367 losers, 71 gainers, and 72 unchanged stocks.

The HNX-Index of the smaller bourse in the North also dropped 4.01 points, or 1.92 percent, to finish at 204.49 points, with 140 losers, 49 gainers, and 153 unchanged stocks.

Market liquidity has improved compared to the last trading session, with the total trading value on the two official exchanges at VND11.5 trillion.

Foreign investors sold a net value of more than VND82 billion on the HoSE.