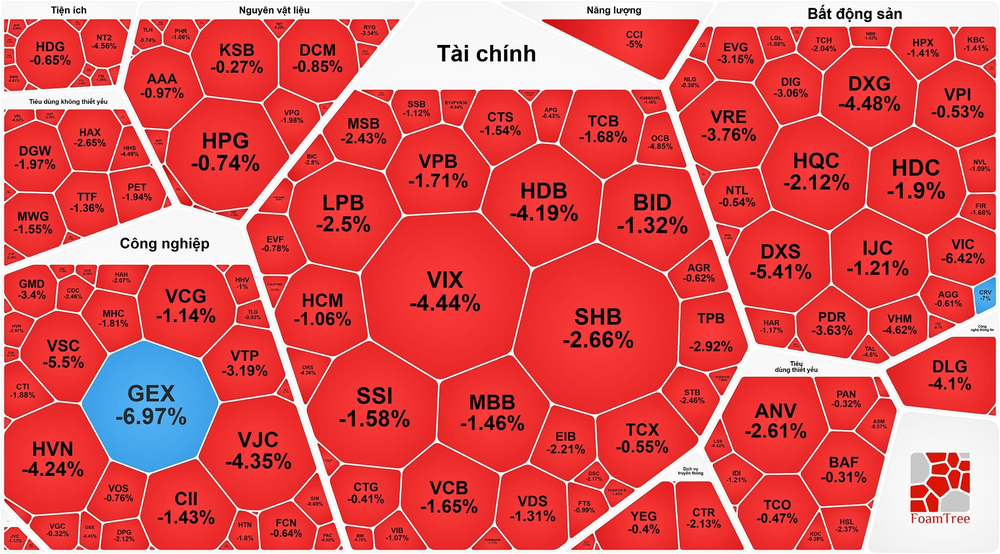

During Friday’s trading session, the stock market witnessed heightened volatility as ETFs restructured their portfolios. At one point, the VN-Index fell more than 43 points before narrowing its losses to nearly 30 points by the close.

Real estate stocks suffered the steepest declines, led by the Vingroup trio — VIC plummeted 6.42 percent, VHM 4.62 percent, and VRE 3.76 percent — collectively erasing nearly 17 points from the VN-Index’s 30-point loss. Other real estate counters also tumbled: CEO fell 6.96 percent, DXG 4.48 percent, DIG 3.06 percent, TCH 2.04 percent, and PDR 3.63 percent.

Banking stocks extended their downtrend, with notable losses across the sector: HDB dropped 4.19 percent, OCB 4.85 percent, SHB 2.66 percent, MSB 2.43 percent, LPB 2.5 percent, TPB 2.92 percent, STB 2.46 percent, VPB 1.71 percent, VCB 1.65 percent, and BID 1.32 percent.

Brokerage stocks were also deep in the red: VIX declined 4.44 percent, ORS 4.26 percent, SSI 1.58 percent, HCM 1.06 percent, and CTS 1.54 percent.

Industrial stocks likewise recorded sharp drops — GEX hit the floor, VSC sank 5.5 percent, VTP slipped 3.19 percent, VJC dived 4.35 percent, HVN retreated 4.34 percent, and GMD reduced 3.4 percent.

The only group maintaining positive momentum was oil and gas, with PVD hitting the ceiling price, PVS rising 1.55 percent, and PVT and BSR edging up nearly 1 percent.

At the close, the VN-Index shed 29.92 points, or 1.79 percent, to finish at 1,639.65 points, with 190 decliners, 127 advancers, and 54 unchanged stocks. On the Hanoi Stock Exchange, the HNX-Index dropped 1.11 points, or 0.42 percent, to 265.85 points, with 92 stocks losing, 66 gaining, and 56 moving flat.

Strong selling pressure drove liquidity higher, with total trading value on the HOSE reaching nearly VND27.7 trillion (up VND3.9 trillion from the previous session). Including the HNX, total market liquidity stood at approximately VND28.5 trillion.

Foreign investors remained net sellers for the third consecutive session on the HOSE, though net outflows narrowed to about VND446 billion — down from the prior two sessions. The three most heavily sold stocks were VIC (over VND230 billion), VHM (nearly VND187 billion), and CTG (around VND125 billion).