The VN-Index dropped nearly 50 points, falling far from the 1,200-point mark established in 2018.

On the trading session of August 5, the Vietnamese stock market opened with the VN-Index losing 23 points due to negative effects from global stocks. Subsequently, the selling-off accelerated, causing the market to plummet uncontrollably, with the VN-Index at one point losing over 50 points before narrowing the decline to nearly 49 points by the close of the session. Nearly 130 stocks on the two main exchanges hit the floor.

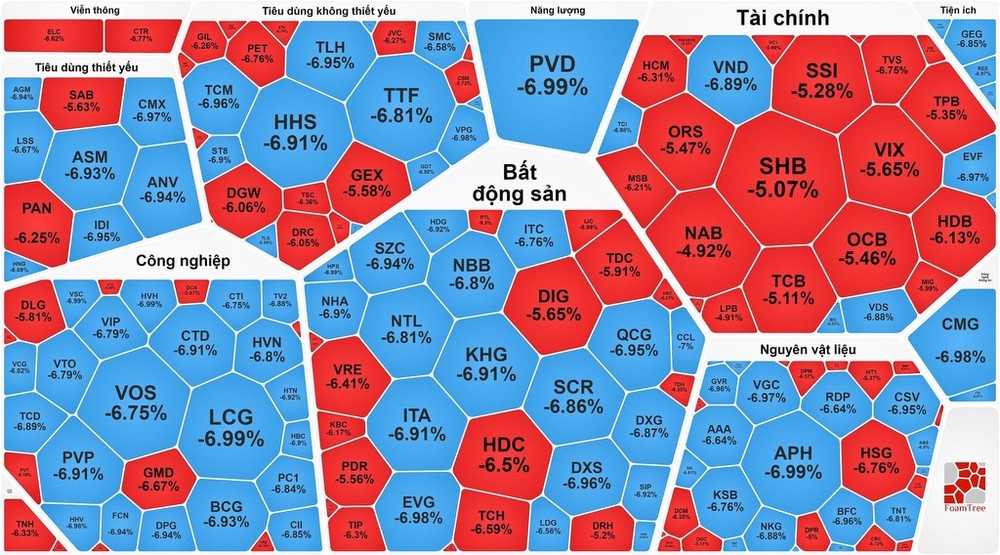

The real estate and construction group saw a series of stocks hit the floor limit, including DXG, HDG, SIP, NBB, SZC, NTL, NHA, VGC, CTD, VCG, FCN, QCG, HBC, and LDG.

The materials and industrial sectors also hit the floor massively, namely GVR, NKG, BFC, AAA, KSB; VOS, VSC, HHV, DPG, LCG, VOS, and HVN.

The securities group showed brief signs of green but ended the session with many stocks hitting the floor or near it. Specifically, VND, VDS, and VFS hit the floor; SSI dropped 5.28 percent, VIX fell 5.65 percent, HCM plunged 6.31 percent, VCI declined 5.99 percent, and MBS sank 5.07 percent.

Although not experiencing widespread declines, the banking sector also dropped steeply. Specifically, HDB slashed by 6.13 percent, TPB dived 5.35 percent, SHB weakened by 5.07 percent, TCB retreated by 5.11 percent, CTG cut by 4.44 percent, LPB reduced by 4.91 percent, and STB diminished by 4.23 percent.

Only a few stocks remained in the green, including EIB, FTS, BSI, and CLL, which increased by nearly 1 percent.

At the close of the trading session, the VN-Index plummeted 48.53 points, or 3.92 percent, to 1,188.07 points, with 448 stocks declining (including 96 hitting the floor), 24 rising, and 25 remaining unchanged.

On the Hanoi exchange, the HNX-Index also collapsed 8.85 points, or 3.82 percent, to 222.71 points, with 171 stocks declining, 33 advancing, and 24 standing still. With the strong sell-off driving up liquidity significantly, the total trading value on the HOSE reached roughly VND23.8 trillion, an increase of nearly VND7.5 trillion compared to the previous week's session.

In this trading session, foreign investors net sold over VND739 billion on the HOSE, breaking a two-session net buying streak. The top stocks sold off the most included HPG with over VND231 billion, FPT with nearly VND89 billion, MWG with nearly VND81 billion, SSI with over VND70 billion, and TCB with nearly VND65 billion.