|

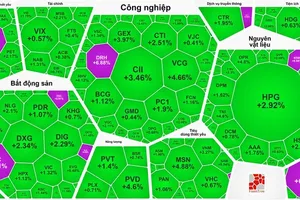

The securities, steel, and real estate stock groups were among those that attracted a substantial amount of capital, contributing to the market's upward trend.

On May 12, the Vietnamese stock market experienced a surge in trading as many stock groups showed strong upward momentum.

Specifically, the securities group saw significant gains, with SSI up 3.8 percent, VND up 1.9 percent, VIX up 5.8 percent, VCI and HCM both up 2 percent, CTS up 2.3 percent, FTS up 3.7 percent, and ORS up 2.7 percent. Meanwhile, the steel stock group saw SMC reach the ceiling price, TLH up 6.3 percent, HPG up 2.8 percent, HSG up 1.2 percent, and NKG up 1.3 percent.

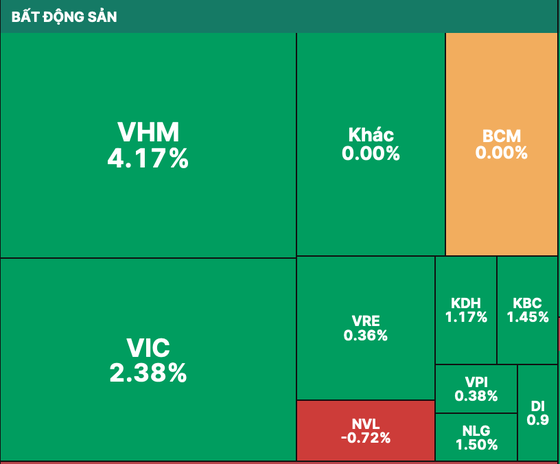

Many real estate stocks continued to maintain strong rising momentum after the previous trading session, such as HBC and FCN hitting the ceiling price, VHM up 4.2 percent, VIC up 2.38 percent, TDC up 1.8 percent, DRH up 1.9 percent, KDH and KBC up over 1 percent. The recent surge in the real estate sector is attributed to positive policy news, including the removal of business and project obstacles. The most recent development is that Prime Minister Pham Minh Chinh has signed a decision to provide preferential interest rates of 4.8 percent per year for loans to buy and rent social housing or build new houses and renovate houses for living purposes.

By the end of the trading session, the VN-Index climbed by 0.93 percent (or 9.78 points) to reach 1,066.9 points, with 222 stocks increasing, 140 decreasing, and 110 remaining unchanged. Similarly, the HNX-Index on the Hanoi Stock Exchange also inched up by 0.32 percent (or 0.69 points) to reach 215.1 points, with 105 winners, 79 losers, and 154 unchanged stocks.

The market liquidity has improved, with a total trading value of over VND13.5 trillion on the two main exchanges. Despite active trading from domestic investors, foreign investors appeared relatively uninterested, with a net purchase of only about VND1.33 billion on the HOSE.