|

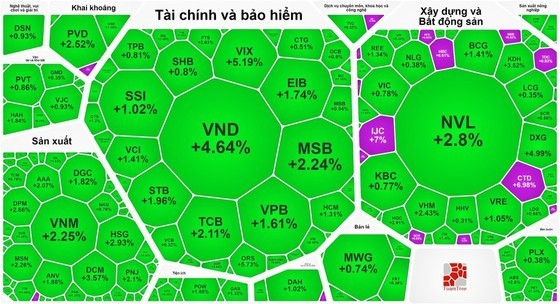

The trading session of the Vietnamese stock market on the last day of the week concluded with an impressive uptrend. The bullish momentum was evident across nearly all sectors, resulting in a market predominantly colored green. Notably, the performance of large-cap stocks played a significant role in sending the VN-Index to its highest level in nearly a year, with 25 out of 30 stocks in the VN30-Index basket recording gains. Among them, several stocks showed robust increases, with NVL rising by 2.8 percent, VHM surging by 2.43 percent, MSN climbing by 2.26 percent, VNM advancing by 2.25 percent, and POW growing by 1.88 percent.

Furthermore, contributing to the significant surge of the VN-Index is the financial and banking stock group. Among this group, a majority of banking stocks witnessed gains, with some performing exceptionally well, such as TCB rising by 2.11 percent, MSB increasing by 2.24 percent, VPB growing by 1.61 percent, and EIB advancing by 1.74 percent.

The securities stock group also recorded remarkable gains, with ORS soaring by 5.73 percent, VIX spiraling by 5.9 percent, VND escalating by 4.64 percent, VCI rallying by 1.41 percent, HCM winning 1.31 percent, and SSI edging up by 1.02 percent.

Regarding the real estate stock group, it remained under the influence of profit-taking and exhibited some divergence. Several stocks reversed their previous gains, with VCG dropping by 3.42 percent, DIG declining by 1.54 percent, and CII and PDR experiencing nearly a 1 percent decrease. On a different note, CTD reached its daily upper limit, DXG surged by 4.99 percent, and NVL rose by 2.8 percent.

By the conclusion of the trading session, the VN-Index rose 10.34 points, or 0.86 percent, closing at 1,207.67 points. Among the listed stocks, 329 saw an increase in value, 139 experienced a decline, and 77 remained unchanged in price.

On the Hanoi Stock Exchange (HNX), the HNX-Index also recorded a positive increase of 1.89 points, 0.8 percent, to reach 237.54 points. Among the listed stocks, 117 showed gains, 71 suffered losses, and 144 stood still. Market liquidity remained at a high level, with the total trading value across the entire market reaching nearly VND24.7 trillion, out of which the Ho Chi Minh Stock Exchange (HOSE) accounted for almost VND22 trillion.

Foreign investors remained active in their net buying activity on the HOSE with a considerable total net buying value of over VND410 billion. Noteworthy stocks that experienced substantial net purchases were VNM with VND122.36 billion, PNJ with VND63.5 billion, HSG with nearly VND61 billion, and VHM with over VND57 billion.