|

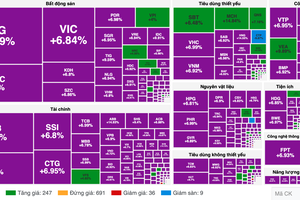

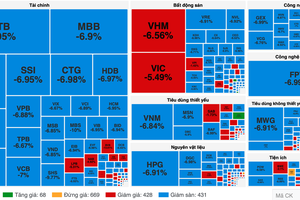

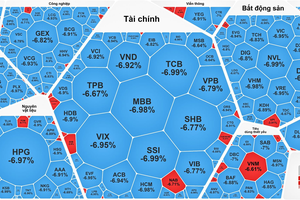

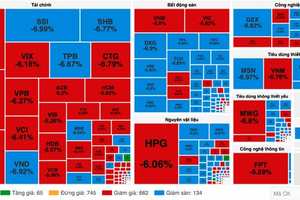

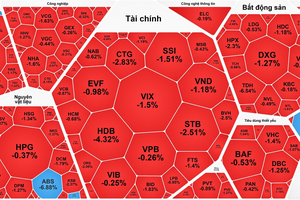

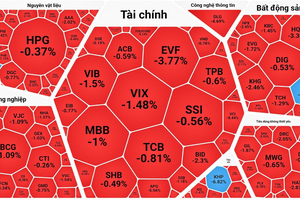

During the morning session on December 1, the Vietnamese stock market faced low liquidity, with the total transaction value on the HOSE exchange below VND5 trillion. Nevertheless, in the late afternoon session, a substantial influx of capital entered the stock market, resulting in a notable recovery of the VN-Index by the session's end despite the overall low liquidity.

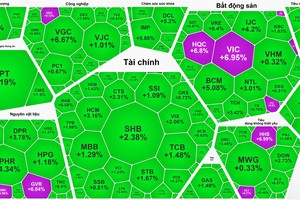

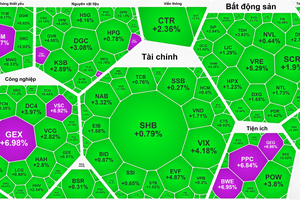

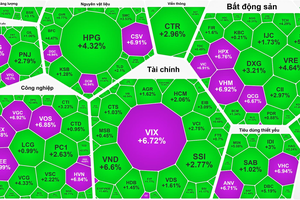

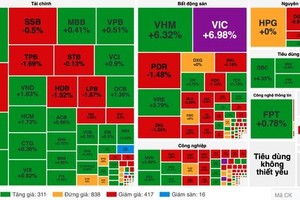

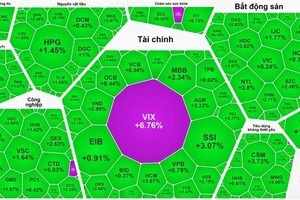

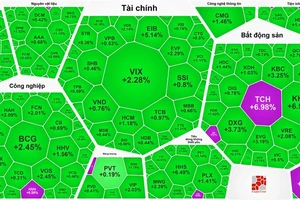

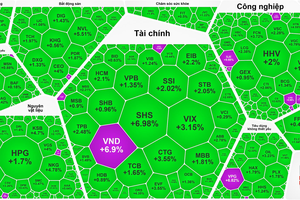

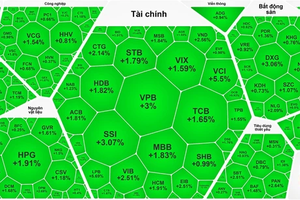

The securities stock sector garnered significant cash flow, leading to widespread gains in the majority of stocks. Specifically, VCI rose by 1.93 percent, SSI increased by 2.24 percent, BSI climbed by 1.9 percent, VIX experienced a 1.83 percent increase, SHS advanced by 1.66 percent, VND gained 1.91 percent, FTS added up 1.42 percent, CTS emerged by 1.45 percent, and ORS edged up by 1.22 percent.

The banking stock sector did not see robust increases, but most stocks managed to stay in green and close near their reference points. For instance, VIB grew by 1.34 percent, BID appreciated by 1.42 percent, VPB went up 1.05 percent, and HDB elevated by 1.11 percent; SHB, TCB, EIB, TPB, and VCB all posted gains of almost 1 percent; CTG, MBB, STB, and ACB maintained their reference prices.

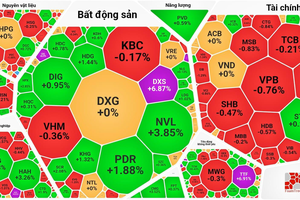

The real estate-construction stock group exhibited significant divergence. Notable gainers in the group include HHV with an increase of 3.53 percent, DIG with 1.62 percent, KBC with 1.45 percent, HDC with 1.23 percent, VRE with 3.17 percent, and LCG with 1.27 percent. On the other hand, some stocks experienced declines. Specifically, TCH dropped by 2.01 percent, QCG declined by 3.14 percent, and HUT fell by 2.01 percent, while CII, BCG, DXS, VHM, PDR, and DXG all retreated by nearly 1 percent.

LDG stock, in particular, hit the floor right from the beginning of the session after the announcement that the Dong Nai Provincial Police had initiated legal proceedings and temporarily detained Nguyen Khanh Hung, Chairman of the Board of Directors cum legal representative of LDG Investment Joint Stock Company for "Customer deception" in the case of 488 illegally constructed villas. At the session's close, LDG continued to be listed for selling at a floor price of VND3,450 per share with a total volume of nearly 40 million shares, but there were no buyers.

Additionally, several individual stocks in the market recorded sharp gains, including PET reaching the daily limit, HAG surging by 5.83 percent, VJC jumping by 3.33 percent, and SBT soaring by 5.3 percent.

At the end of the trading session, the VN-Index rose by 8.03 points, or 0.73 percent, to reach 1,102.16 points, supported by 254 gaining stocks, 227 declining stocks, and 101 unchanged stocks.

Meanwhile, at the Hanoi Stock Exchange, the HNX-Index also increased slightly by 0.11 points, or 0.39 percent, to reach 226.26 points, with 67 advancers, 80 decliners, and 72 unchanged stocks.

Market liquidity experienced a sharp slump, with the total transaction value across the entire market totaling approximately VND13.7 trillion—a reduction of VND3.5 trillion compared to the previous session. Of which, the HOSE recorded a transaction value of VND12 trillion. Foreign investors kept selling massively, continuing a net selling trend of nearly VND209 billion on the HOSE.