In the stock market trading session on January 30, the stock market was no longer “green on the outside, red on the inside” as there was a unified trend across various industry sectors.

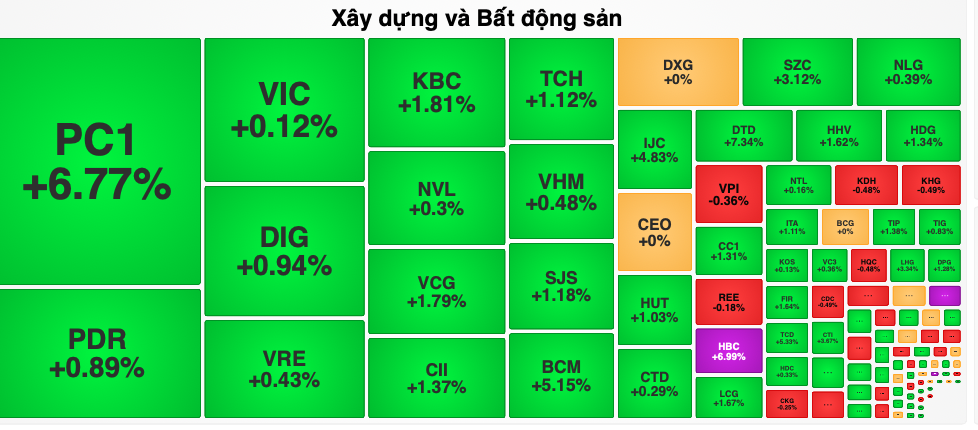

The real estate and construction stock group showed the highest gains, with the industrial real estate stocks leading the surge. Notably, BCM jumped by 5.15 percent, IDC rose by 4.68 percent, SZC advanced by 3.12 percent, KBC went up by 1.82 percent, and GVR climbed by 2 percent. Additionally, the commercial real estate and construction group also increased sharply. Specifically, HBC hit the trading limit, CII grew by 1.37 percent, TCH increased by 1.12 percent, HHV moved up by 1.62 percent, HDG emerged by 1.34 percent, and VCG gained by 1.79 percent.

The securities stock group was also painted in green, with HCM rising by 1.89 percent, CTS winning by 1.39 percent, and SSI, VND, SHS, AGR, VIX, and BSI recording an increase of nearly 1 percent.

The banking group exhibited some divergence but leaned more towards the green side. Specifically, HDB earned 2.1 percent, STB strengthened by 1.15 percent, OCB surged by 3.73 percent, and TPB, EIB, LPB, and VIB posted a near 1 percent rise. On the contrary, large-cap stocks in the group, such as BID, VCB, CTG, TCB, MBB, decreased by nearly 1 percent, contributing to pinning down the VN-Index.

Furthermore, the manufacturing stock group displayed positive trading, with DRC hitting the trading limit, DBC enlarging by 3.85 percent, VGC rallying by 3.09 percent, PAN enhancing by 2.36 percent, and TNG soaring by 4.59 percent.

At the end of the trading day, the VN-Index hiked by 3.96 points, or 0.34 percent, to reach 1,179.65 points, with 266 stocks advancing, 174 declining, and 112 unchanged stocks.

Closing on the Hanoi Stock Exchange, the HNX-Index also mounted by 1.61 points, or 0.7 percent, to 230.66 points, featuring 90 gainers, 72 losers, and 70 unchanged stocks.

Market liquidity slumped, with the total trading value on the HOSE reaching around VND13.7 trillion, down VND400 billion compared to the previous week's last trading session. Foreign investors also returned to net buying, contributing nearly VND127 billion on the HOSE.