The continuous selling by foreign investors for the 15th session in a row exerted considerable pressure on the market. In March 2024, foreign investors net sold nearly VND11.3 trillion on the HOSE - the highest net selling figure to date.

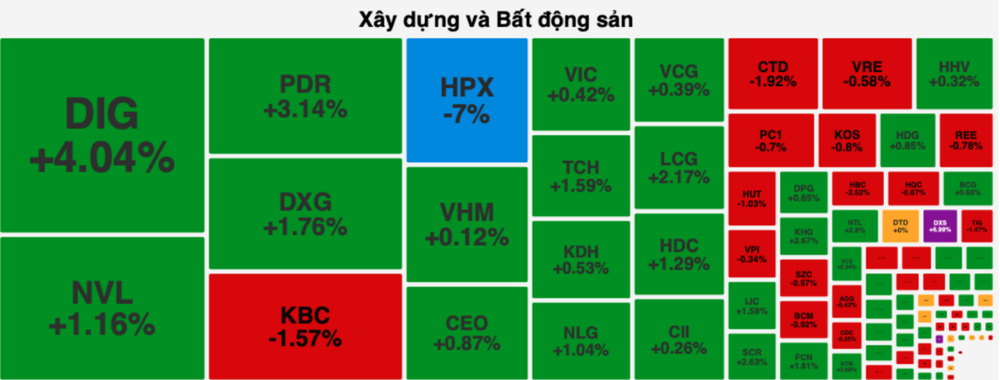

The stock market in the first trading session of April 2024 continued to face strong selling pressure, resulting in moments when the VN-Index dropped by nearly 9 points. However, it rebounded well thanks to robust increases in the real estate and construction stock group. Specifically, DXS hit the ceiling, DIG jumped by 4.04 percent, PDR escalated by 3.14 percent, NTL surged by 2.8 percent, DXG rallied by 1.76 percent, TCH strengthened by 1.59 percent, HDC grew by 1.29 percent, NLG enhanced by 1.04 percent, SCR enlarged by 2.63 percent, LCG expanded by 2.17 percent, and CEO, CII, VH, VIC, VCG, and HDG rose by nearly 1 percent.

In contrast, banking stocks were flooded in red. CTG decreased by 1.55 percent, TPB slumped by 1.83 percent, MSB dropped by 1.03 percent, MBB plummeted by 1.97 percent, LPB declined by 1.42 percent, EIB devalued by 1.09 percent, VIB lost by 1.22 percent, and VPB, HDB, TCB, ACB, NAB, and OCB slid by almost 1 percent.

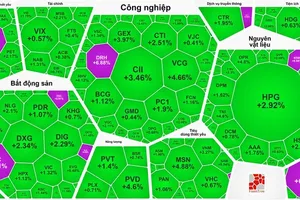

The securities sector showed a more positive trend but with some variation. Specifically, SHS emerged by 1 percent, and SSI, HCM, FTS, BSI, and ORS increased by almost 1 percent. On the other hand, VCI, AGR, BVS, and VND decreased by nearly 1 percent.

Moreover, some oil and gas stocks performed well. PVS soared by 3.83 percent, and PVD climbed by 1.85 percent, following the news of significant progress in the Block B - O Mon Gas to Power Project as the Vietnam Oil and Gas Group (PVN) and its partners signed crucial contracts, moving towards a final investment decision.

At the close of the trading session, the VN-Index dipped by 2.57 points, or 0.20 percent, to 1,281.52 points, with 327 stocks declining, 144 advancing, and 77 remaining unchanged.

Conversely, on the Hanoi Stock Exchange, the HNX-Index rose by 0.32 points, or 1.13 percent, to 242.90 points, with 92 gainers, 74 losers, and 71 unchanged stocks.

Liquidity remained relatively stable, with the total trading value on the HOSE reaching nearly VND23.3 trillion, the same as the previous session.

Foreign investors extended their net selling streak on the HOSE for the 15th consecutive session, with a total net selling value of roughly VND723 billion. Notably, the most heavily offloaded stocks included MSN with over VND247 billion, VNM with nearly VND160 billion, SSI with around VND171 billion, DGC with approximately VND86 billion, and CTG with nearly VND43 billion.

Experts explained that beyond the global capital flow restructuring, the substantial net selling by foreign investors in recent times was mainly attributed to the sharp rise in domestic exchange rates.

On April 1, the selling price of US dollars at commercial banks surged to nearly VND25,000 per dollar, while the US dollar price in the free market reached VND25,700 per dollar. The strong pressure from the USD/VND exchange rate hike may prompt foreign investors to persist in withdrawing capital from the stock market in the coming time.