Following the booming trading session yesterday, the market maintained heightened liquidity in the subsequent session. However, a sharp increase in profit-taking activity ensued, notably with foreign investors continuing to dump shares worth VND912 billion on the HOSE floor, leading to a downturn in the VN-Index.

The stock market's trading session on March 14 experienced significant turbulence as it reached its highest level in 18 months. The VN-Index started the session with continued optimism, yet by the afternoon session, intense selling pressure caused a rapid decline in the VN-Index before a slight recovery at the session's close.

Although securities stocks failed to maintain a sharp gain during the session, many stocks still kept good growth. VIX jumped by 3.48 percent, SHS gained by 3.24 percent, ORS increased by 2.23, VFS climbed by 2.43 percent, SBS inched up by 1.27 percent, VDS rose by 1.36 percent, and VCI edged up by 1.16 percent.

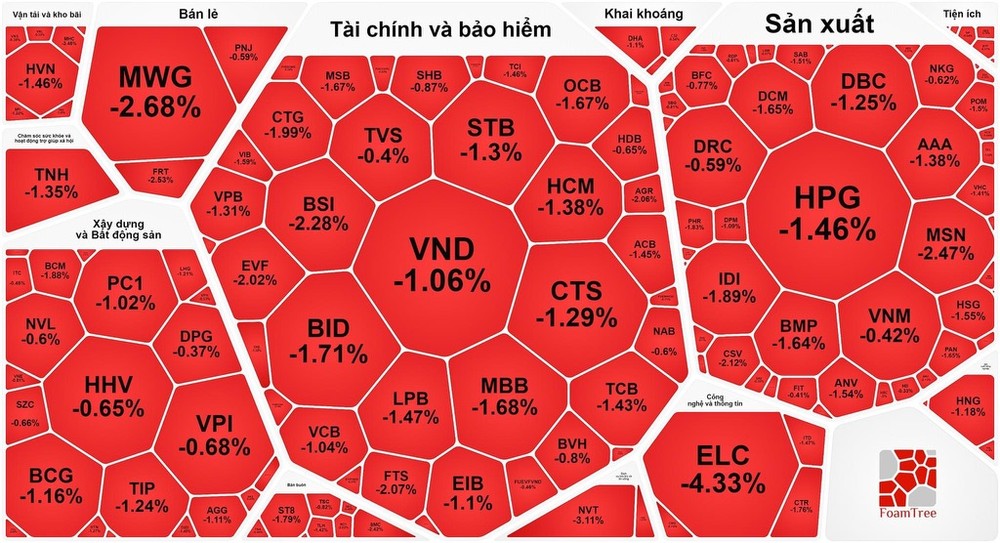

On the contrary, banking stocks were flooded in red again, contributing to pressure on the index. CTG fell by 1.99 percent, MBB tumbled by 1.68 percent, STB declined by 1.3 percent, EIB dropped by 1.1 percent, VIB reduced by 1.59 percent, ACB retreated by 1.45 percent, BID lost by 1.71 percent, VCB cut by 1.04 percent, MSB slashed by 1.67 percent, and VPB decreased by 1.31 percent.

The real estate and construction sector displayed a divergence but leaned towards positive territory, with FCN soaring by 4.17 percent, KBC surging by 3.19 percent, VIC growing by 2.11 percent, DIG strengthening by 1.85 percent, CEO adding up by 1.38 percent, HDC enlarging by 2.13 percent, HDG building up by 2.05 percent, CTD advancing by 1.72 percent, and NLG and LCG both emerging by nearly 1 percent. In contrast, BCM slumped by 1.88 percent, HUT collapsed by 1.06 percent, and BCG demolished by 1.16 percent; VHM, PDR, SZC, DXG, KDH, and HHV dipped by nearly 1 percent.

Oil and gas stocks saw improved trading, with many stocks cooling off at the end of the session but still closing higher. PVT hit the ceiling, PVD jumped by 4.94 percent, PVS elevated by 2.71 percent, and BSR heightened by 2.11 percent.

At the close of the trading session, the VN-Index sank by 6.25 points, or 0.49 percent, to close at 1,264.26 points, with 292 stocks declining, 193 gaining, and 69 remaining unchanged.

Meanwhile, on the Hanoi Stock Exchange, the HNX-Index rose by 1.48 points, or 0.62 percent, to finish at 239.68 points, with 100 winners, 82 losers, and 64 unchanged stocks.

Market liquidity continued to increase, with the total trading value on the HOSE reaching nearly VND28 trillion, an increase of about VND1.7 trillion compared to the previous session.

Foreign investors continued their sell-offs on the HOSE, recording their third consecutive session of net selling with a total value of nearly VND 912 billion, focusing on large-cap stocks, including VHM with nearly VND166 billion, VNM with nearly VND142 billion, SBT with VND80.26 billion, HPG with VND63.71 billion, DBC with VND57.18 billion, MWG with VND56.02 billion, HSG with nearly VND53 billion, and VCB with nearly VND51 billion.