The stock market trading session on December 5 saw a deceleration in cash flow compared to the previous day. In addition, foreign investors continued to engage in massive sell-offs, exerting substantial pressure on the market. This resulted in a nearly 6-point decline in the VN-Index, with the prevalence of declining stocks over advancing ones.

After a strong upward trend, the securities stock group was flooded in red due to profit-taking pressure from investors. However, the decline was not considerable, hovering around 1 percent. Specifically, BSI dropped by 1.04 percent, while VIX, SHS, VCI, FTS, SSI, VND, ORS, and AGR recorded nearly a 1 percent decrease.

The banking stock group also leaned towards the red zone, with STB declining by 1.42 percent, VPB falling by 1.79 percent, and SHB losing by 1.35 percent. Meanwhile, VCB, TCB, HDB, TPB, CTG, MSB, ACB, and BID registered a decrease of nearly 1 percent.

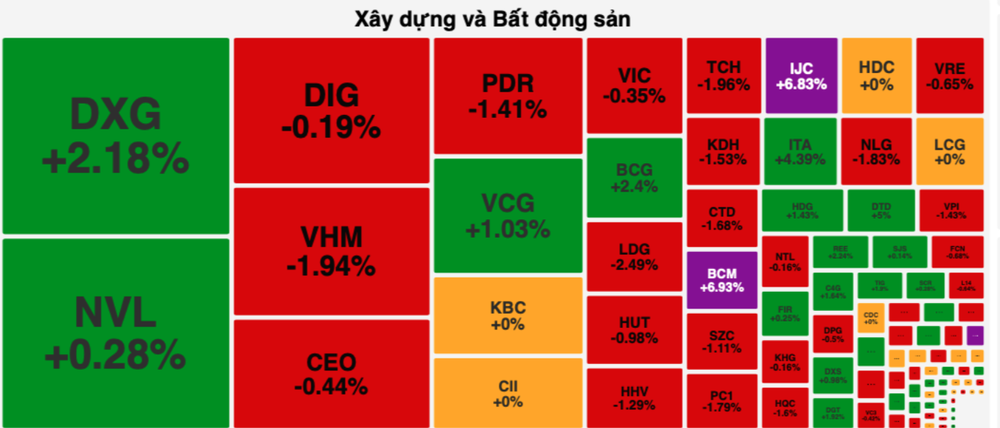

Despite maintaining the most green stocks, the real estate and construction stock group showed some divergences. Notably, stocks that experienced an increase include BCM and IJC, both hitting the daily price ceiling; DXG rose by 2.18 percent, BCG climbed by 2.4 percent, ITA escalated by 4.39 percent, HDG emerged by 1.43 percent, VCG advanced by 1.03 percent, and IDC enlarged by 1.2 percent.

NVL, SCR, and DXS also rallied by nearly 1 percent. On the flip side, TCH slumped by 1.96 percent, NLG reduced by 1.83 percent, CTD demolished by 1.68 percent, PDR retreated by 1.41 percent, HHV collapsed by 1.29 percent, and SZC slid by 1.11 percent. The Vingroup trio simultaneously experienced a drop, with VHM slashing by 1.94 percent and VRE and VIC weakening by nearly 1 percent.

Regarding LDG stock, after two consecutive sessions of decline and a decrease in liquidity, LDG surprisingly saw a strong buying momentum in this trading session, with tens of millions of shares in the sell order book absorbed. By the end of the trading session, LDG had only dropped by 2.49 percent from the floor price, settling at VND3,130 per share.

At the end of the trading session, the VN-Index declined 4.52 points, or 0.40 percent, closing at 1,115.97 points, with 356 stocks decreasing, 141 stocks increasing, and 96 stocks maintaining their previous values.

On the Hanoi Stock Exchange, the HNX-Index saw a marginal increase of 0.03 points, or 0.01 percent, finishing at 231.34 points. Of the index, 63 stocks advanced, 99 stocks declined, and 66 stocks stood still. Notably, the market liquidity dropped sharply, with the total trading value plummeting to nearly VND19.9 trillion—marking a reduction of about VND9 trillion compared to the previous session.

Foreign investors underwent a notable net selling activity on the HOSE, with a cumulative net selling value reaching nearly VND1.56 trillion. Stocks witnessing the most substantial net selling were HPG with approximately VND188 billion, VHM with over VND172 billion, VCB with over VND100 billion, VNM with nearly VND92 billion, and VND with roughly VND84 billion.