|

On September 8, despite more stocks rising than declining, the VN-Index closed with a slight decrease, primarily due to significant drops in several blue-chip stocks. Specifically, VIC fell by 2.8 percent, VHM decreased by 2 percent, VRE declined by 2.31 percent, STB went down by 1.52 percent, and CTG, TCB, and MBB each experienced declines of over 1 percent.

Moreover, many bank stocks also showed negative trends, including BID, ACB, TPB, MSB, and VIB. The securities sector displayed mixed performances, with SSI rising by 0.3 percent, VCI increasing by 0.43 percent, HCM surging by 1.34 percent, FTS gaining 0.57 percent, and MBS growing by 0.48 percent. In contrast, VND dropped by 0.63 percent, VIX retreated by 0.5 percent, CTS slid by 0.33 percent, and AGR devalued by 0.56 percent.

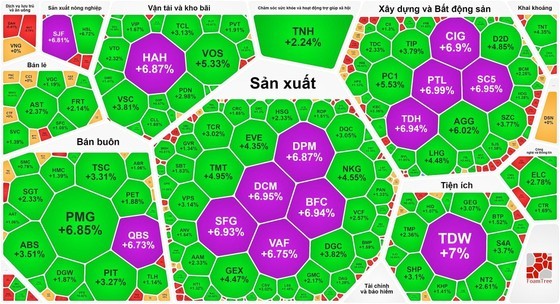

Despite substantial downward pressure from various stock groups, the VN-Index only registered a minor dip, primarily due to the robust performance of the real estate, fertilizer, and chemical stocks.

Specifically, the fertilizer and chemical sector, comprising stocks like DCM, DPM, VFC, LAS, and BFC, all saw substantial surges, hitting their limit-up levels, driven by significant buying demand. This surge was prompted by news that China had temporarily suspended urea fertilizer exports from some of its manufacturers.

In the real estate stock category, excluding the three Vingroup companies, which all experienced declines, several stocks displayed strong performance, including BCM going up by 2.25 percent, NVL rising by 1.85 percent, KBC surging by 3.36 percent, VCG climbing by 2.62 percent, PC1 advancing by 5.53 percent, ITA increasing by 2.44 percent, SZC growing by 3.77 percent, and AGG jumping by 6.02 percent.

At the conclusion of the trading session, the VN-Index lost 1.66 points, or 0.13 percent, closing at 1,241.48 points, with 252 stocks falling, 254 gaining, and 61 remaining unchanged.

On the Hanoi Stock Exchange, the HNX-Index showed a slight increase of 0.06 points, or 0.02 percent, to reach 256.2 points, featuring 118 stocks in the green, 88 in the red, and 62 unchanged.

Market liquidity remained robust, with the total trading value on the HOSE reaching nearly VND26.4 trillion, and the total trading value touched roughly VND29.6 trillion. A positive development was that foreign investors ceased their net selling and moved into a slight net buying position, with approximately VND99 billion on the HOSE.