Illustrative photo

Illustrative photo

Many of the F0 investors are now seriously considering withdrawing capital from the stock market, after receiving consistent battering on the floor.

Scare among F0 investors

According to data received from the Securities Depository Centers, the number of new accounts opened in November were 221,314, an increase of 70 percent compared to October. This is a new record for the number of new accounts opened in a month on the stock market. In this, most are newly opened accounts of domestic individual investors totalling 220,602 accounts. The number of new accounts opened in November by domestic institutional investors were 215, and foreign individual investors also increased sharply by 473 accounts. Since the beginning of the year until now, the cumulative number of new accounts opened on the stock market are 1.3 million. This brings the total number of current accounts of investors on the stock market at around four million accounts.

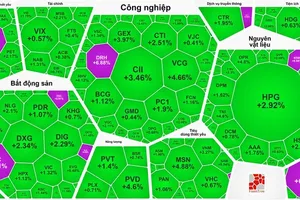

Although the number of new accounts continue to increase, the cash flow has suddenly dropped sharply in the last few trading sessions of the week. For example, the liquidity of HoSE decreased to just over 700 million securities units, equivalent to around VND20,000 bn, from more than 1 billion securities units transferred per session, worth more than VND30,000 bn. Market liquidity dropped not only in the red sessions, but also appeared in gaining sessions.

Looking at the declining liquidity, it is easy to see that capital flow from large institutions and foreign investors did not have much fluctuation. Cash flow was withdrawn from individual investors, which was the driving force to push the VN Index to correct the 1,500-point mark in November. During the plunge, individual investors sold very strongly. At the trading session on 6 December, organizations, proprietary traders, and foreign investors, net bought VND 272 bn, VND 197 bn, and VND 303 bn, respectively. On the other hand, individual investors net sold VND 772 bn.

It can be seen that panic selling of individual investors in the trading sessions of the VN Index dropped sharply, showing their apprehension instead of excitement that was palpable in previous months. The sell-off in the sessions of stocks fell to the floor causing investors to suffer heavy losses, while the beneficiaries were still organizations and foreign investors, as after the drop, VN-Index rebound strongly in the following sessions.

F0 Investors face losses

For many investors, selling and cutting losses in the trading sessions of the market with sharp decline is also a success. In fact, there are many retail investors who are holding shares of companies at high prices, but even if they want to cut losses, it is still not enough, such as in the case of the Sao Thai Duong Investment Joint Stock Company (SJF), IDI Multinational Development, I.D.I International Development & Investment Corporation (IDI), Thanh Nam Group Joint Stock Company (TNI), or Simco Song Da Joint Stock Company (SDA). On the stock exchanges, investors accidentally grab stocks that are always in a state of volatility.

After six consecutive sessions of hitting the floor from VND 24,100 per share to VND 15,700 per share, SJF leaders had to reassure investors. According to Mr. Nguyen Tri Thien, Chairman of the Board of Directors, SJF did not have any negative events affecting the stock price. The reason why stocks fluctuate strongly may be the cash flow of both investment and speculation that anticipated the news that SJF may become a supplier of bamboo container flooring for Hoa Phat Group JSC (HPG). However, the first sample product of SJF did not meet the standards due to the use of block pressing technology. Therefore, SJF has invested in a new raw material machine to make composite samples. The second sample of SJF has been sent to HPG for testing and the results are expected in mid-December.

The positive information from the top management of the business still could not relieve the selling pressure of SJF in the market. In the following sessions, investors holding stocks of SJF stepped on each other to sell. By the trading session on 9 December, this stock continued to plunge to just VND 12,700 per share. At this price, shareholders who bought at the peak price of more than VND 24,000 per share in the trading session on 26 November had to bear a loss of nearly 50 percent.

F0 euphoria dying out

If Mr. Thien's statement is actually honest, it is likely that SJF is being undervalued and he himself recognizes this phenomenon. In fact, only speculative cash flow is capable of pushing SJF up nearly ten times compared to the beginning of the year, even though CP is under warning due to loss of business. On the CK forum, many believe that there is a driver behind the rally of the group of 4 codes, namely, SJF, IDI, TNI and SDA.

Saigon Investment did a research and found that the people who set up closed groups on Zalo or Facebook to key the stock codes for F0 investors were inexperienced. In order to create trust among F0 investors, these people collect a monthly fee with the commitment that shares purchased by investors will increase over time. However, when the goal is reached to push the price up to sell and take profit, these people delete the group and investors are left in the lurch, as in the case of the stocks mentioned above.

Not only do the stocks become speculative, but many F0s are also wrong when buying into basic stocks such as banks and steel as recommended by securities companies. Many F0 become bitter after the loss and borrow more money to deal with additional losses. However, many other F0 who stumble after loss of investment due to speculation, have moved on to take courses on securities, learn more about markets, or have chosen the safer option to retire.