|

Despite the dominance of losing stocks, the VN-Index kept rising, thanks to the strong performance of blue-chip stocks, especially in the king group. However, the VN-Index has not yet reached the 1,200-point milestone.

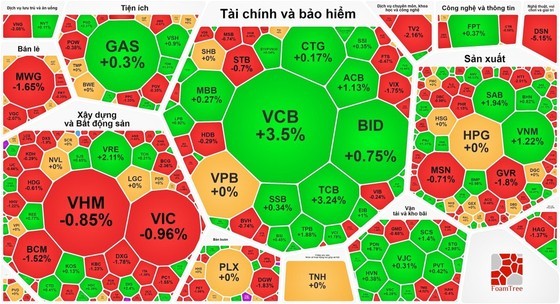

During the trading session on July 25, the Vietnamese stock market continued its positive streak for the third consecutive day, driven by a strong performance in the banking sector. Notably, VCB increased by 3.5 percent, TCB rose by 3.24 percent, ACB climbed by 1.13 percent, TPB went up by 1.88 percent, EIB saw a one-percent increase, and OCB surged by 3.53 percent. Besides, several other blue-chip stocks also demonstrated good performance, with VNM rising by 1.22 percent, SAB increasing by 1.94 percent, and VRE gaining 2.11 percent.

In contrast, the securities group showed significant divergence, with VCI rising by 1.78 percent, TVS increasing by 2.85 percent, and SSI edging up by 1 percent, whereas VND declined by 0.79 percent, HCM decreased by 0.66 percent, VIX fell by 1.75 percent, and CTS dropped by 1.4 percent.

On the other hand, the real estate group reversed sharply after a strong uptrend in the previous session. Specifically, BCM decreased by 1.52 percent, KBC dropped by 1.23 percent, DXG declined by 1.78 percent, CII reduced by 1.48 percent, DXS slumped by 1.9 percent, CRE slid by 1.22 percent, SZC retreated by 1.78 percent, AGG went down by 1.42 percent, KHG lost by 2.16 percent, and LCG fell by 2.74 percent.

At the close of the trading session, the VN-Index rose by 5.18 points, or 0.44 percent, to reach 1,195.9 points, with 207 gainers, 72 unchanged stocks, and 250 decliners.

Meanwhile, on the Hanoi Stock Exchange, the HNX-Index also increased by 0.4 points, or 0.17 percent, to close at 236.93 points, with 82 gainers, 107 decliners, and 143 unchanged stocks.

The market maintains high liquidity with the total trading value surpassing VND22.8 trillion. An encouraging sign is that foreign investors have halted selling and resumed net buying, with a modest amount of over VND87 billion on both HOSE and HNX exchanges.