Investors have shown little interest in channeling funds into stock purchases, resulting in the VN-Index dropping for the third consecutive session. Foreign investors have also resumed net selling, putting an end to their previous streak of ten consecutive sessions of net buying.

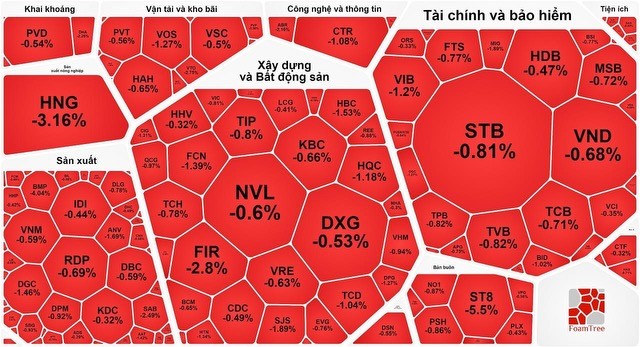

The stock market on January 25 witnessed sluggish trading as the cash flow disappeared. Despite a modest decrease of just over 2 points in the VN-Index, the red color dominated the market. The number of declining stocks outweighed the advancing ones, more than doubling in comparison.

The real estate construction stock group exhibited some divergence, yet the prevalence of red was still more pronounced. HBC declined by 1.53 percent, SJC dropped by 1.89 percent, while NVL, KBC, DXG, CEO, BCM, HHV, LCG, TCH, and the Vingroup trio - VHM, VIC, VRE - all experienced a nearly 1 percent drop. Conversely, NTL jumped by 5.65 percent, CTD increased by 1.19 percent, and BCG rose by 1.56 percent, while KDH, NLG, PDR, HDC recorded an increase of nearly 1 percent.

The financial and banking sector also showed a clear tendency towards the red. Specifically, BID declined by 1.02 percent, and VIB retreated by 1.2 percent; TCB, MSB, STB, HDB, VCB, and TPB slid by nearly 1 percent. The securities group had only a few stocks that managed to stay in positive territory, with CTS edging up by 1.57 percent and HCM inching up by nearly 1 percent. Meanwhile, VND, SSI, VIX, BSI, VFS, and VCI all experienced a decrease of nearly 1 percent.

On the other hand, the retail stock group exhibited quite positive trading dynamics, with FRT hitting the daily trading limit, DGW rallying by 2.61 percent, and MWG advancing by 1.8 percent.

At the end of the trading session, the VN-Index lost 2.6 points, or 0.22 percent, to close at 1,170.37 points, with 301 stocks decreasing, 140 increasing, and 117 remaining unchanged.

Concluding the session on the Hanoi Stock Exchange, the HNX-Index also went down by 0.01 point to 228.52 points, with 68 declining stocks, 81 advancing, and 78 standing still.

Market liquidity dropped significantly, with the total trading value on the HOSE reaching only around VND11.4 trillion. Foreign investors returned to net selling on the HOSE, with a net selling value of nearly VND130 billion, ceasing their previous ten consecutive net buying sessions.