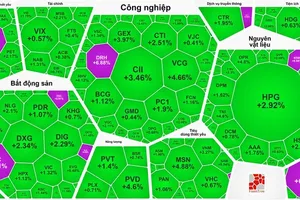

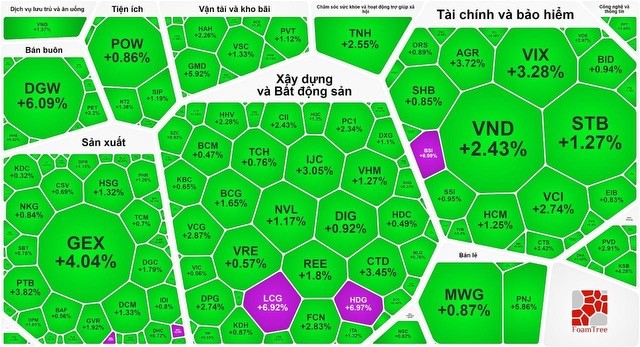

The money flow shifted towards mid-cap and small-cap stocks, resulting in a widespread green in the market.

In the stock market's trading session at the beginning of March 2024, minor corrections prompted an influx of money into stock purchases, bolstering the upward trend. Although the VN-Index closed the session with a gain of nearly 6 points, the majority of stocks experienced an increase.

The cash flow poured back into the securities stock group, propelling it to the forefront. BSI hit the ceiling, AGR increased by 3.72 percent, CTS rose by 3.42 percent, VIX climbed by 3.28 percent, VCI surged by 2.74 percent, SHS advanced by 1.69 percent, HCM grew by 1.25 percent, FTS gained 1.75 percent.

Meanwhile, the banking sector displayed signs of money withdrawal, leaning towards the red despite some divergence. Specifically, VPB declined by 1.26 percent, ACB, MSB, TCB, MBB, and LPB all decreased by nearly 1 percent. Conversely, ABB rose by 1.2 percent, CTG, EIB, BID, SSB, and SHB all saw increases of nearly 1 percent.

The real estate and construction stock group saw positive momentum, with HDG and LCG hitting their trading limits. Additionally, the trio of Vingroup recorded gains. Particularly, VHM rose by 1.27 percent, VRE and VIC increased by nearly 1 percent. Other notable increases include CTD soaring by 3.45 percent, IJC climbing by 3.05 percent, FCN increasing by 2.83 percent, CII advancing by 2.43 percent, VCG escalating by 2.87 percent, BCG rising by 1.65 percent, CEO increasing by 1.8 percent, NVL adding up by 1.17 percent, and DXG edging up by 1.1 percent.

Moreover, the manufacturing, retail, and transportation-logistics sectors also showed strong performance. Notably, retail stocks saw significant gains. Specifically, PNJ surged by 5.86 percent, DGW rose by 6.09 percent, and FPT increased by 1.65 percent. In manufacturing sector, GEX jumped by 4.04 percent, DGC strengthened by 1.79 percent, DCM mounted by 1.33 percent, HSG enhanced by 1.32 percent, and GVR rallied by 1.92 percent. The transportation-logistics sector saw GMD escalated by 5.92 percent, HAH elevated by 2.26 percent, and VSC enlarged by 1.33 percent.

At the close of the trading session, the VN-Index climbed by 5.55 points, or 0.44 percent, to reach 1,258.28 points, with 293 stocks advancing, 182 stocks declining, and 82 stocks standing still.

Meanwhile, the HNX-Index at the Hanoi Stock Exchange also rose by 0.97 points, or 0.41 percent, to 236.43 points, with 94 stocks gaining, 63 stocks losing, and 70 stocks remaining unchanged. Trading volume surged significantly, with the Ho Chi Minh Stock Exchange alone reaching a total trading value of nearly VND26.2 trillion (nearly US$1.1 billion), an increase of VND3.5 trillion compared to the previous session. When considering the entire market, the trading volume exceeded VND28.8 trillion.

Foreign investors have also returned to net buying with over VND200 billion on the Ho Chi Minh Stock Exchange.