|

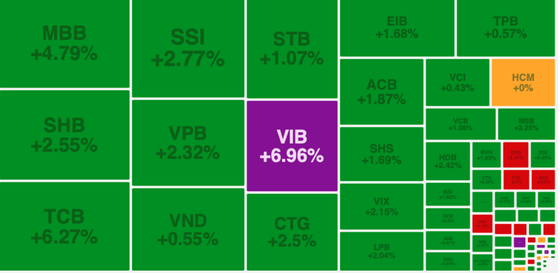

Despite continued net selling of VND223.43 billion by foreign investors on the HoSE, the Vietnamese stock market surpassed 1,090 points on June 2, thanks to the resurgence of banking stocks. VIB, KLB, and NVB reached the ceiling price, while TCB rose by 6.27 percent, MBB increased by 4.79 percent, CTG went up by 2.50 percent, and MSB surged by 3.3 percent.

The return of king stocks significantly boosted the market. However, penny stocks that had previously surged, including DRH, OGC, EVG, BMP, LSS, CRE, ITA, KHG, TCH, and BCG, were under heavy selling pressure, leading to a decrease of over 2 percent. Additionally, large-cap stocks performed well, with MWG increasing by 3.82 percent, SSI by 2.77 percent, PLX by 2.14 percent, VCG by 4.08 percent, CII by 4 percent, and GEX by 3.64 percent, pushing up the VN-Index by nearly 13 points.

In this explosive trading session, foreign investors continued to be net sellers, with a total sell-off of over VND250 billion on both the HoSE and HNX. The most heavily sold-off stocks on the HoSE included VPB, VNM, STB, HCM, MSN, EIB, GMD, and NLG.

At the close of the trading session, the VN-Index recorded a gain of 12.45 points, or 1.15 percent, to reach 1,090.84 points. Among the listed stocks, 244 moved forward, 150 declined, and 79 remained unchanged.

Likewise, at the Hanoi Stock Exchange, the HNX-Index rose by 2.06 points, or 0.92 percent, to close at 226.03 points. The HNX saw 108 stocks rise, 78 stocks fall, and 147 stocks stand still.

Market liquidity significantly improved, with the total trading value on both main exchanges surpassing VND20.1 trillion.