On the trading session of December 14, the Vietnamese stock market reversed its course, witnessing a decline due to the heightened cautious outlook among investors, which has led to cash flow staying away from the market.

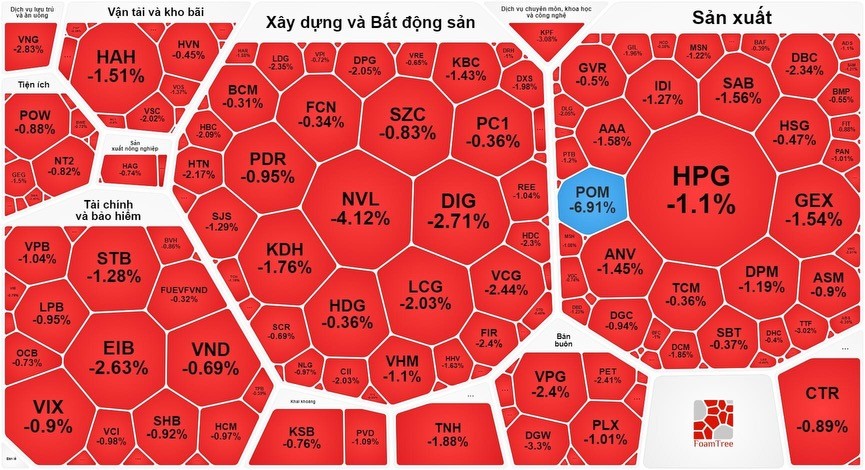

The securities sector, often considered the market bellwether, could no longer keep the green color and ended the session with a slump. Specifically, VDS declined by 1.22 percent; VCI, VND, VIX, HCM, and VFS all registered nearly a 1 percent decrease.

Meanwhile, the real estate and construction segment continued its substantial downturn, with NVL slashing 4.12 percent, DIG demolishing 2.71 percent, VCG collapsing 2.44 percent, HDC destructing 2.3 percent, CII wrecking 2.03 percent, KDH crumbling 1.76 percent. Of the Vingroup trio, VHM fell by 1.1 percent, and VRE and VIC both slid by nearly 1 percent.

The banking stock group could not escape from the market's downward trend. However, some large-cap banking stocks such as VCB, TCB, ACB, and HDB managed to maintain a positive performance, helping prevent a steep decline in the VN-Index. On the other hand, EIB, STB, SHB, TPB, LPB, VIB, and VPB simultaneously dropped.

In the manufacturing sector, several stocks saw drops of over 1 percent, such as DCM with a decrease of 1.85 percent, MSN with a decrease of 1.22 percent, HPG with a decrease of 1.1 percent, GEX with a decrease of 1.54 percent, and SAB with a decrease of 1.56 percent.

Closing the trading session, the VN-Index weakened by 4.07 points, or 0.37 percent, to close at 1,110.13 points. The market consisted of 384 decliners, 138 advancers, and 85 unchanged stocks. Similarly, on the Hanoi Stock Exchange, the HNX-Index also decreased by 1.19 points, or 0.52 percent, to reach 227.23 points, featuring 113 losing stocks, 50 wining stocks, and 63 unchanged stocks.

Market liquidity witnessed a sharp drop, with the total trading value on the HOSE plummeting to only VND14.6 trillion.