|

Due to the news that Novaland Company (NVL) requested a payment deferral for a batch of corporate bonds worth VND1 trillion, NVL shares fell to the floor, spreading the bearish sentiment to several real estate stocks, making this stock group drop hard.

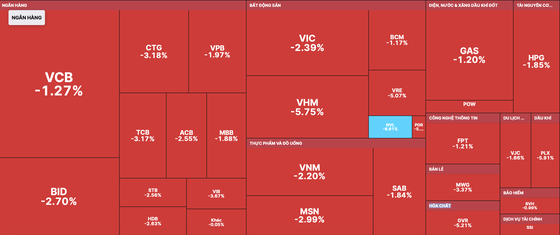

Specifically, DXG and DRH hit the floor, HDG and VHM lost 5.8 percent, PDR slumped 6 percent, CEO sank 5.7 percent, DIG plummeted 6.5 percent, NLG plunged 6.6 percent, and VIC went down 2.4 percent.

Not only residential real estate stocks but industrial park real estate stocks also declined. For instance, SZC fell to the floor, IDC collapsed by 6.2 percent, ITA decreased by 3.9 percent, and KSB reduced by 3.8 percent. A few rare real estate stocks that managed to keep the green at the end of the session were SCR and LDG, with an increase of 1.7 percent. HQC alone hit the ceiling.

After a strong sell-off, the VN-Index sometimes recovered robustly, thanks to the high demand. However, suddenly, at the end of the session, sell orders were massively pushed to the market, causing the market to be flooded in red. All 30 stocks in the VN30-Index basket dropped, causing the VN-Index to plunge steeply. Besides NVL, VHM, and PDR, PLX slashed by 5.9 percent, SSI weakened by 5.6 percent, GVR retreated by 5.2 percent, VRE lessened by 5.1 percent, and TPB diminished by 5 percent. The remaining stocks waned from 3 to nearly 4 percent, such as MSN, TCB, CTG, MWG, POW, and VIB.

With this strong sell-off trading session, most stocks in the market, such as seafood, agriculture, services, and transportation, shrank by 4-5 percent.

Petroleum stocks were the bright spot in the market when PVS, PVD, and BSR went upstream and increased by 2-3 percent. Unfortunately, in the face of the strong sell-off at the end of the trading session, this stock group also made a reverse at the close, with PVS down 1.52 percent, PVD down 4.05 percent, and BSR down 2.92 percent.

Securities stocks were also being dumped heavily, causing HCM to hit the floor, SSI, VIX, and VND to evaporate 5.6 percent, CTS to dive 6.3 percent, FTS to contract 5.5 percent, and VCI to crash 4.9 percent.

Closing the session, the VN-Index dropped 27.95 points, or 2.58 percent, to 1,054.28 points, with 365 losers, 60 gainers, and 85 standstill stocks. Meanwhile, in Hanoi, the HNX-Index cut 4.12 points, or 1.93 percent, to close at 209.96 points, with 114 losers, 61 gainers, and 167 unchanged stocks.

Market liquidity increased sharply, with the total trading value on the two trading floors at more than VND14.5 trillion. Foreign investors continued to sell over VND356 billion on the HoSE.