|

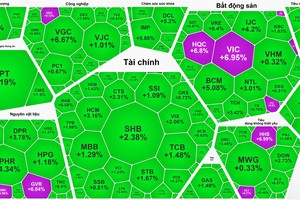

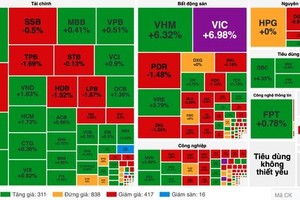

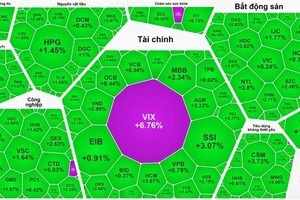

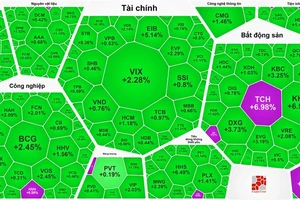

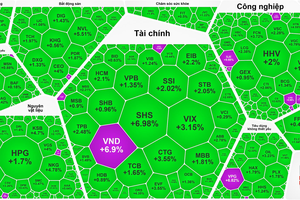

Vietnam’s stock market opened a rather gloomy morning trading session. Many key stocks fell from the beginning. For instance, VIC sank 2.68 percent; MSN shrank 2.8 percent; HPG dropped 2.84 percent; VHM weakened 1.56 percent. The bright spot in the market belonged to the group of retail and information technology stocks, such as PET, DGW, and FRT, which climbed strongly by 3-4.5 percent.

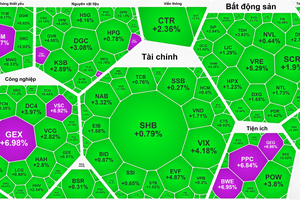

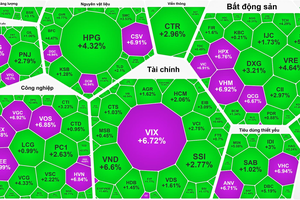

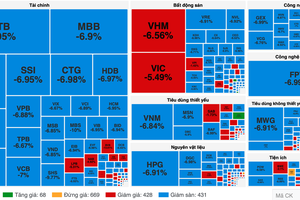

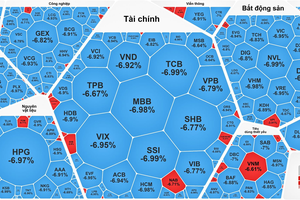

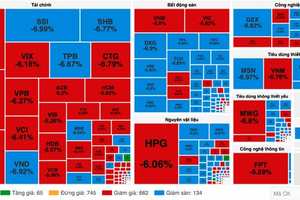

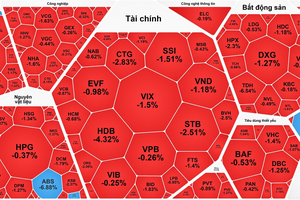

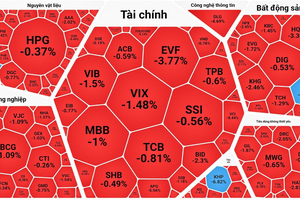

In the afternoon session, the selling force in the market strengthened, so the VN-Index continuously dropped. Especially at the end of the trading session, the market plunged rapidly due to the strong sell-off, causing several large-cap stocks in many fields to plummet sharply.

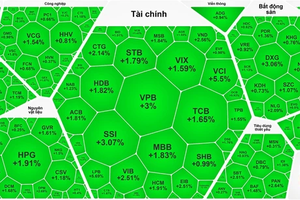

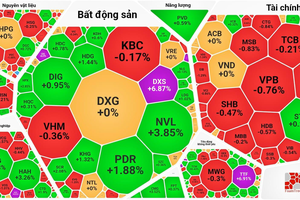

Specifically, among banking stocks, VCB fell 4.2 percent, BID slid 2.67 percent, CTG cut 2.34 percent, VPB declined 2.97 percent, and VIB erased 2.54 percent. Among real estate stocks, PDR hit the floor, VHM went down 2.4 percent, VRE collapsed by 3.22 percent, VIC retreated by 1.79 percent, KBC decreased by 3.7 percent, and NVL slashed by 5.19 percent. In addition, other stocks that contributed to the steep drop of the VN-Index included GVR with minus 5.13 percent, MWG with minus 3.08 percent, and HPG with minus 6.62 percent.

Foreign investors were still net buyers for the fifth consecutive session but cooled down, with a total net buying value of only about VND37.26 billion on the HoSE.

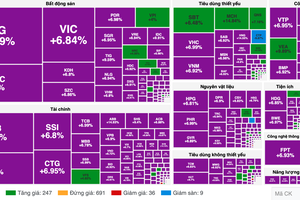

Closing the session, the VN-Index dived 23.45 points, or 2.15 percent, to 1,065.84 points, with 342 losers, 77 gainers, and 52 unchanged stocks.

In Hanoi, the HNX-Index also demolished 4.47 points, or 2.08 percent, to close at 210 points, with 127 losers, 44 gainers, and 171 unchanged stocks.

Market liquidity improved compared to the previous session, with the total trading value on the two official exchanges at about VND13.25 trillion.