The Ministry of Finance has announced a draft decision from the Prime Minister to provide credit to students, trainees, and STEM researchers. The ministry is now seeking public feedback on the proposal.

According to the draft, the maximum loan for 1 student includes the entire tuition fee that the student must pay after deducting scholarships and other financial support from the school as confirmed by the school and living expenses, amounts to VND5 million (US$192.12) a month. The loan interest rate for STEM students is equal to the loan interest rate for poor households at the Social Policy Bank in each period according to the provisions of law. Currently, the interest rate is 6.6 percent per year.

If a student is granted a loan at the start of their academic program (typically four years), the total maximum loan term can extend up to nine years. This period does not include any additional time granted under debt extension provisions for borrowers facing repayment difficulties. This extended term provides sufficient flexibility for borrowers to manage repayments to the bank, aligning with the terms currently applied to students in financially challenging situations.

Based on Ministry of Finance surveys, annual tuition fees show considerable variation depending on the program type. A student can pay between VND30 million and VND50 million for standard STEM programs. For advanced or internationally affiliated programs, the cost ranges from VND50 million to VND70 million annually. Programs offered at private or international higher education institutions have the highest tuition fees, falling in the range of VND200 million to VND300 million per year.

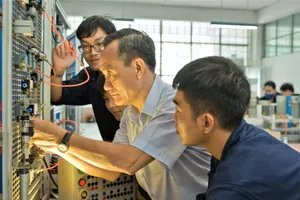

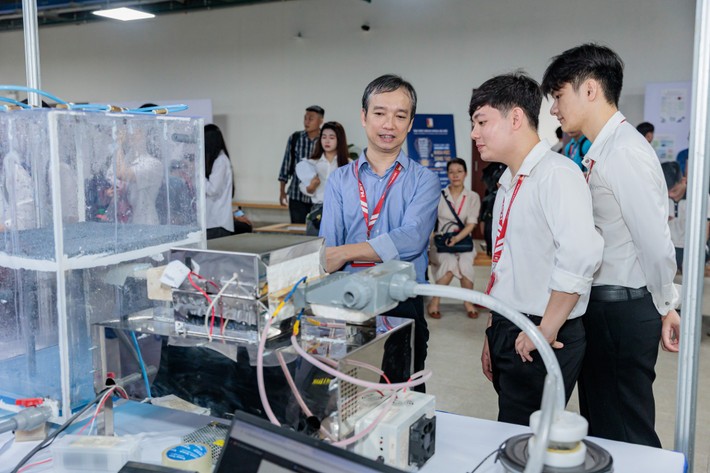

STEM students enroll in an educational institution in science, technology, engineering, or mathematics academic program.