During the meeting in the United Kingdom’s financial capital, Minister Nguyen Van Thang provided a robust overview of Vietnam’s economic performance. He reported that the economy has continued to show numerous positive indicators through the first eight months of 2025, with second-quarter GDP growth hitting an impressive 7.96 percent. The Government is confidently targeting an annual growth rate of 8.3 to 8.5 percent for the year.

The Minister highlighted a sharp increase in foreign investment, with total registered, adjusted, and contributed capital from foreign investors reaching nearly US$26.1 billion in the first eight months, a 27.3-percent surge compared to the same period last year. Goods import-export turnover also saw a healthy 16.3 percent rise, totaling $598 billion.

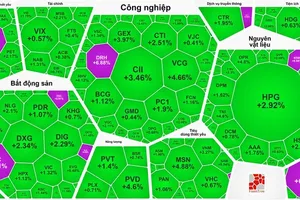

Focusing on the nation’s capital markets, he noted that by the end of August 2025, Vietnam’s stock market capitalization had reached nearly $352 billion, equivalent to 79.5 percent of the 2024 estimated GDP.

Market liquidity has become notably robust, with some trading sessions exceeding $3 billion. The year-to-date average daily trading value now stands at over $1.1 billion, ranking it among the most active markets in the ASEAN region.

A key topic of discussion was the much-anticipated reclassification of Vietnam’s stock market. Minister Nguyen Van Thang affirmed that the Vietnamese Government has been intensely focused on implementing the necessary reforms to achieve an upgrade from “frontier” to “emerging” market status by index provider FTSE International Limited (FTSE).

He stressed that Vietnam has diligently worked to meet FTSE’s criteria, including the synchronous implementation of new policies designed to facilitate foreign capital inflows.

In the spirit of sustainable development, Minister Nguyen Van Thang proposed several areas for future cooperation with the LSE. He expressed a keen interest in exchanging expertise on refining regulatory frameworks, enhancing market surveillance, and applying international standards for corporate governance and information disclosure.

Furthermore, Vietnam is eager to learn from the LSE’s experience in developing new and diverse financial products, particularly green bonds, sustainable bonds, and derivatives.

The Minister also called for joint investment promotion programs to forge deeper connections between Vietnamese enterprises and international investors, especially those in the UK and Europe. Additionally, he sought collaboration on training programs to enhance the capacity of Vietnam’s financial workforce and the application of Fintech, AI, and Blockchain to improve market efficiency.

In response, LSE CEO Julia Hoggett shared insights into the Exchange’s operations and discussed ongoing cooperation initiatives designed to support Vietnam’s market upgrade. These include the existing partnership between FTSE Russell and Vietnam’s State Securities Commission (SSC) to address reclassification criteria and an MOU on index development between the Vietnam Exchange (VNX) and FTSE Russell.

CEO Julia Hoggett expressed strong confidence in the future development of Vietnam’s stock market and affirmed that the LSE would continue to actively support its bid for emerging market status. She voiced her expectation that the partnership would enter a new phase of development, with the LSE serving as an effective “gateway” connecting the Vietnamese market to global capital.

The meeting concluded with the two parties signing a memorandum of understanding, officially establishing a strategic partnership to enhance Vietnam’s capital market infrastructure and accelerate its international integration.